Changes to Age Pension Eligibility Tests

In July 2015 the Government passed legislation to change the Centrelink Age Pension assets test by increasing the lower thresholds and decreasing the upper thresholds. These changes will come into effect from 1 January 2017. This means that pensioners on the lower end of the asset threshold may be better off, however, those who currently have assets over $250,000 may receive a lower part pension or lose it all together.

How the Asset test works

The asset test works by applying lower and upper thresholds to the amount of assets that can be held (excluding your family home) to establish your eligibility to the age pension. For those pensioners that have assets between these thresholds, a tapering system is used. Currently, the pension entitlement is reduced by $1.50 per $1,000 over the relevant lower threshold.

For example, currently a single homeowner would be eligible for the full age pension if their assets (excluding their family home) are under $209,000. A single homeowner with assets above $209,000 but below $793,750 would be eligible for a part pension. And a single homeowner with assets over $793,750 would not be eligible for a pension at all.

What affect will the changes have?

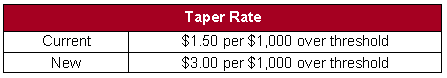

Taper rate

The taper rate will be increased from $1.50 to $3 per $1,000 from 1 January 2017. This means that pensioners with part pensions will have their entitlements reduced by $3 per $1,000 above the lower threshold. For example, currently if you are $10,000 over the lower threshold, your rate of pension will be reduced by $15 per fortnight. From 1 January 2017, if you are $10,000 over the lower threshold, your rate of pension will be reduced by $30 per fortnight.

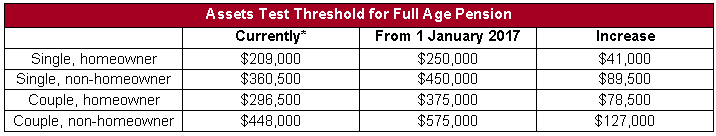

Lower thresholds

The increase to the lower thresholds will result in pensioners with assets under $250,000 being eligible for the full pension. For example, a single homeowner with assets of $240,000 would currently be receiving a part pension due to the tapering of $1.50 for each $1,000 over the $209,000 threshold. However, when the new thresholds come into effect they would not be subject to tapering as their assets are under the new lower threshold of $250,000.

* The asset test limits are updated in January, March, July and September each year.

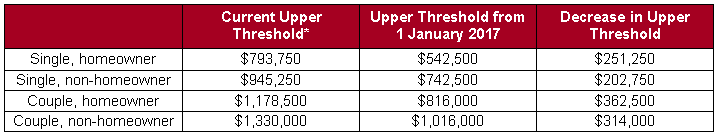

Upper thresholds

The decrease in the upper thresholds will result in less pensioners being eligible for a part pension. For example a single homeowner with assets of $600,000 would be eligible for a part pension under the current rules, however, from 1 January 2017 they will exceed the upper threshold of $542,500 and therefore, not be eligible for the age pension.

* The asset test limits are updated in January, March, July and September each year.

Concession Cards

Individuals who lose their pension on 1 January 2017 will automatically get a non-income tested:

- Low Income Health Care Card, or

- Commonwealth Seniors Health Card if they are over age pension age

Asset Test Estimator

The Department of Human Services (Centrelink) has added a simple Asset Test Estimator calculator to help you assess your position in relation to the asset test. You can access the Estimator here.

We suggest that if you believe you may be affected by these changes that you talk to your financial adviser to discuss your options.

DISCLAIMER: The contents of this publication are general in nature and we accept no responsibility for persons acting on information contained herein. The content of this newsletter does not constitute specific advice and readers are encouraged to consult their Ruddicks adviser on any matters of interest. © Ruddicks 2016