Super Funds & Retirees

- Temporary early access to superannuation; and

- Temporary reduction in mandated rate of minimum pension withdrawals.

Please note that these measures have now been legislated, and we urge you to consult with us as soon as possible if you wish to take advantage of them. Note that anyone who simply withdraws money from their SMSF but does not follow the right process, will be subject to the usual rules. This could result in substantial tax and other penalties – it is vital to follow the process established under the new rules.

1. Early access to superannuation

Special access to existing superannuation balances will be available to those who have experienced significant reductions in their income or are unemployed or who have been retrenched. This measure is intended to assist individuals who would not otherwise be able to access their superannuation at this time.

How much?

Eligible individuals will be able to apply online through myGov to access up to $10,000 of their superannuation before 1 July 2020, with a further $10,000 maximum withdrawal from 1 July 2020 for approximately three months.

You will be able to apply for early release of your superannuation from mid-April 2020, however it is not yet clear how long it will take for the ATO to process an application and for the fund to make payment to the individual.

Eligibility

To apply for early release you must satisfy any one or more of the following requirements:

- You are unemployed; or

- You are eligible to receive a job seeker payment, youth allowance for jobseekers, parenting payment (which includes the single and partnered payments), special benefit or farm household allowance; or

- On or after 1 January 2020:

- you were made redundant; or

- your working hours were reduced by 20% or more; or

- if you are a sole trader — your business was suspended or there was a reduction in your turnover of 20% or more.

People accessing their superannuation will not need to pay tax on amounts released and the money they withdraw will not affect Centrelink or Veterans’ Affairs payments.

There are no income or assets tests for this measure. A high-wage individual who remains employed and has other assets could access this payment under the proposed rules as long as their salary has been reduced by 20% after 1 January 2020.

Process

For superannuation funds other than Self-Managed Superannuation Funds (SMSFs):

If you are eligible for this new ground of early release, you can apply directly to the ATO through the myGov website.

You will need to certify that you meet the above eligibility criteria. After the ATO has processed your application, they will issue you with a determination. The ATO will also provide a copy of this determination to your superannuation fund, which will advise them to release your superannuation payment. Your fund will then make the payment to you, without you needing to apply to them directly.

To ensure you receive your payment as soon as possible, you should contact your fund to check that they have your correct details, including your current bank account details and proof of identity documents.

IMPORTANT:

- Any applications for this early release of super must be made within six months of the new legislation commencing, being 24 March.

- It is expected that individuals will self-assess their eligibility to apply for the early release of superannuation. If we administer your SMSF and wish to take up this measure, please consult us as soon as possible.

- Individuals are restricted to a single application in a financial year. This means that a person cannot make multiple applications in the same financial year to release more than $10,000 for that year.

- It also means that a person who requests an amount of less than $10,000 in their application for a financial year cannot make a subsequent application in the same financial year to release the difference between that originally requested amount and the $10,000 limit (for example, a person who has requested that $6,000 be released cannot subsequently request that another $4,000 be released).

- However, a person with multiple accounts who has less than $10,000 in any one account is able to nominate more than one account from which amounts are to be released when they request it.

- It is therefore important to consider carefully how much you wish to withdraw, as you may not be able to top up this amount later within the same financial year.

TO DO NOW: if you have a non-SMSF fund and think you may wish to apply for a temporary early release payment, you should ensure that your MyGov account is set up, your details are up to date and your superannuation account is linked to it.

Additional information is available on the ATO website.

For SMSFs:

Separate arrangements will apply if you are a member of a SMSF. Further guidance will be available on the ATO website in due course and we will keep you updated.

For members of SMSFs administered by us, we will prepare the fund documentation to evidence the withdrawal of monies under this new condition of release at no cost.

2. Temporary reduction in minimum pension withdrawal rates

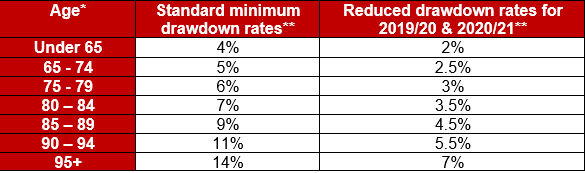

Reminiscent of the reductions during the Global Financial Crisis, the minimum pension drawdown requirements for account-based pensions, allocated pensions and market-linked pensions will be halved for the 2020 and 2021 financial years.

The revised rates will be as follows:

* The member's age is determined at either 1 July in the financial year in which the payment is made, or the commencement day of the pension or annuity, if that is the year in which it commences.

** The rate is applied to the pension account balance as at 1 July of each financial year in order to calculate the minimum repayment. For the current year, many superannuation funds may find that their balance has reduced significantly since 1 July 2019, however the minimum drawdown rate is still based on the balance at that date.

The Treasury factsheet in relation to this measure is available here.

Who would benefit from this measure?

- Cash-strapped super funds that would have needed to sell assets in order to meet the minimum payment requirements. As the economy is continuing to suffer, such sales would likely crystallise losses or be on suboptimal terms.

- Retirees who do not need additional income, and would be able to keep more money in the super fund, relieving the pressure to sell assets.

OUR TIPS FOR MEMBERS OF SMSF RECEIVING ACCOUNT BASED PENSIONS:

- If you have not yet taken your minimum payment for the 2020 year, consider whether you want to take advantage of this measure and wait until the reduction is legislated.

- If you have already taken more than 50% of the current minimum, you will not be able to return surplus pension payments into superannuation under this measure.

TO DO NOW: Pension recipients who want to minimise the amount they withdraw from superannuation in the current financial year should review and adjust any automatic periodic payment arrangements.

Additional information is available on the ATO website.

DISCLAIMER:

Liability limited by a scheme approved under Professional Standards Legislation.

The content of this newsletter is general in nature. It does not constitute specific advice and readers are encouraged to consult their Ruddicks adviser on any matters of interest. Ruddicks accepts no liability for errors or omissions, or for any loss or damage suffered as a result of any person acting without such advice. This information is current as at 24 March 2020, and was published around that time. Ruddicks particularly accepts no obligation or responsibility for updating this publication for events, including changes to the law, the Australian Taxation Office’s interpretation of the law, or Government announcements arising after that time.

Any advice provided is not ‘financial product advice’ as defined by the Corporations Act. Ruddicks is not licensed to provide financial product advice and taxation is only one of the matters that you need to consider when making a decision on a financial product. You should consider seeking advice from an Australian Financial Services licensee before making any decisions in relation to a financial product. © Ruddicks 2020