JobKeeper 2.0

The JobKeeper extension legislation was passed by the Senate on Tuesday 1 September, extending the program by six months to 28 March 2021. Under the extended rules, JobKeeper 2.0 will replace the current flat $1,500 a fortnight subsidy with a two-tiered system.

The Tax Institute has issued a detailed updated infographic summarising the JobKeeper changes.

Additionally, the definition of eligible employees has been expanded to include employees engaged after 1 March 2020 and before 1 July 2020. The new definition applies from 3 August 2020. We go through the new employee eligibility rules in detail here.

UPDATE 3 DECEMBER:

The ATO has extended certain dates in relation to JobKeeper:

- employees need to have been paid for JobKeeper fortnight 20 (21 December 2020 - 3 January 2021) by the end of Monday 4 January 2021 (previously Sunday 3 January 2021)

- employees need to have been paid for JobKeeper fortnight 21 (4 January 2021 - 17 January 2021) by 31 January 2021 (previously 14 January 2021).

You will need to pay your eligible employees at least the JobKeeper amount that applies to them each JobKeeper fortnight. For JobKeeper extension 2, this will be either $1,000 for tier 1 or $650 for tier 2.

Further information: JobKeeper Key Dates.

UPDATE 13 OCTOBER:

The Commissioner of Taxation has registered a new, additional alternative decline in turnover test for the purposes of qualifying for JobKeeper 2.0. The test addresses a situation where the business had temporarily ceased trading for at least a week during the comparable 2019 period (e.g. when testing for the September 2020 quarter, the comparable period is the September 2019 quarter). Please see below for details.

Eligibility and turnover tests

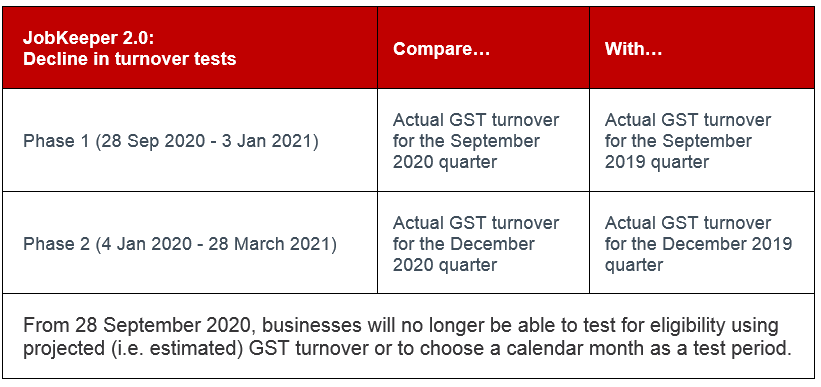

Broadly, to qualify for the JobKeeper payment for the period from 28 September 2020 to 3 January 2021, the reduction in turnover test will now need to be met only for the September 2020 quarter (as compared to the September 2019 quarter).

To qualify for the JobKeeper payment for the period from 4 January 2021 to 28 March 2021, the reduction in turnover test will now need to be met only for the December 2020 quarter (as compared to the December 2019 quarter).

- The required decline in turnover to qualify for JobKeeper 2.0 remains at 30% for most businesses and 15% for most Not-For-Profits.

- A business would have to separately qualify for Phase 1 payments and then for Phase 2 payments.

- A business may drop out for Phase 1 due to not being able to meet the decline in turnover test for the September 2020 quarter, but may still re-enter Phase 2 if they subsequently qualify based on the December 2020 quarter results.

- To qualify for Phase 1 and 2 payments, an entity would need to meet the 30% decline in turnover test for each of the quarters listed in the table (i.e. each quarter is tested separately, and not in aggregate).

- First-time entry into the JobKeeper program is still available for businesses that meet the qualifying criteria for the first time after 27 September 2020.

- Businesses and Not-For-Profits will generally be able to assess eligibility based on details

reported in the Business Activity Statement (BAS). Alternative arrangements will be put in place for businesses and Not-For-Profits that are not required to lodge a BAS. - The deadline to lodge the September BAS is due in late October, and the December BAS is due in late January (monthly) or late February (quarterly). Therefore businesses will need to assess their JobKeeper eligibility in advance of the BAS deadline in order to meet the wage condition.

Decline in turnover test for JobKeeper 2.0 - what has changed

- The turnover tests for JobKeeper 2.0 are based on actual, not projected results.

- The test period can only be a quarter (September 2020 for Phase 1 and December 2020 for Phase 2), and monthly test periods can no longer be used under JobKeeper 2.0.

- Under JobKeeper 2.0, the turnover test has to include all capital sales (e.g. selling off plant and equipment to raise funds), not just the ordinary business income.

Cash, accruals, or...?

The basis of determining the timing of income for the purposes of the decline in turnover test is closely linked to the business' GST reporting basis, i.e. cash or accruals, as per the entity's Business Activity Statements (BAS) reporting. The ATO has released a Legislative Instrument that specifies the appropriate method to use:

Note: "test period" is the September or December 2020 quarter you are testing; and "comparison period" is the 2019 equivalent quarter.

If an entity is not registered for GST during either test period – the entity may choose to use the cash basis or the accruals basis

If an entity has always been registered for GST and never changed their accounting basis – the entity needs to use that accounting basis

If an entity is registered for GST at the beginning of the relevant comparison period (i.e. the 2019 September or December quarter) – the entity needs to use the accounting basis from the the first BAS of the relevant comparison period

If the entity became registered for GST during the relevant comparison period – the entity needs to use the accounting basis from the first BAS of the relevant comparison period

If an entity changed their accounting basis during or after the start of the relevant comparison period – the entity needs to use the accounting basis from the first BAS of the relevant comparison period

If an entity cancelled their GST registration during or after the relevant comparison period – the entity needs to use the accounting basis from the first BAS of the relevant comparison period

If an entity registered for GST after the end of the relevant comparison period (i.e. after September 2019 or December 2019 quarter) – the entity needs to use the accounting basis used at the beginning of its turnover test period (i.e. at the beginning of the 2020 quarter being tested).

WHAT THIS MEANS: ultimately, only entities that are not registered for GST have any choice in how they calculate their turnover for the decline in turnover test. Entities that are already registered will have to use the method they use for the quarterly or monthly BAS reporting unless they have recently changed their GST accounting method.

Alternative turnover tests

On Wednesday 23 September, the ATO released another Legislative Instrument, which introduced several alternative turnover tests which closely mirror the original alternative turnover tests under JobKeeper 1.0.

Importantly, an alternative turnover test is only available to an entity if the September 2019 or December 2019 quarter is not an appropriate comparison period for the entity.

The alternative tests available address the following situations:

- An entity commenced business after the first day of the relevant 2019 comparison period - this test applies to entities that were not operating any business. It does not apply to entities that were already operating one or more businesses and commenced an additional business.

- An entity acquired or disposed of part of their business at, or after, the start of the relevant comparison period in 2019.

- An entity has restructured part or all of their business at, or after, the start of the relevant comparison period in 2019, including more than one restructure.

- An entity has had an increase in current GST turnover by 50% or more in the 12 months immediately before either the applicable turnover test period or 1 March 2020, or 25% or more in the 6 months immediately before either the applicable turnover test period or 1 March 2020, or 12.5% or more in the 3 months immediately before either the applicable turnover test period or 1 March 2020.

- An entity has been affected by a drought or other natural disaster in the relevant comparison period in 2019.

- An entity has an irregular current GST turnover that is not cyclical, such as can occur in the building and construction sector.

- An entity is a sole trader or a small partnership and the sole trader or one of the partners did not work for all or part of the relevant comparison period because they were sick, injured or on leave during the relevant comparison period. The test is intended to address the situation where it is the individual, the sole trader or partner, who works in the business to generate turnover, and hence only applies to those sole traders and small partnerships which do not have employees.

UPDATE 13 OCTOBER: The Commissioner of Taxation has registered a new, additional alternative decline in turnover test for the purposes of qualifying for JobKeeper 2.0.

The test addresses a situation where the business had temporarily ceased trading for at least a week during the comparable 2019 period (e.g. when testing for the September 2020 quarter, the comparable period is the September 2019 quarter). The business must have re-opened by 28 September 2020 to be able to rely on this test.

The temporary business cessation must have happened due to events or circumstances outside of the ordinary course of business. Examples of such circumstances given in the legislative instrument include a move to new purpose-built premises and blackouts. Cessation of trading for public holidays, planned leave or during the off-season for a seasonal business will not qualify for the use of this test.

If a business is eligible to use this alternative test, they have a choice of 2 options: either

- compare the September 2020 quarter (or the December 2020 quarter for phase 2 of JobKeeper 2.0) to the equivalent period in the 2018 year, i.e. September 2018 quarter or December 2018 quarter, OR

- compare the September 2020 quarter (or the December 2020 quarter for phase 2 of JobKeeper 2.0) to the 3 months immediately before the month when the business ceased trading.

If you believe your business may fall into the categories contemplated by the alternative tests, please contact us to discuss as soon as possible.

New payment tiers

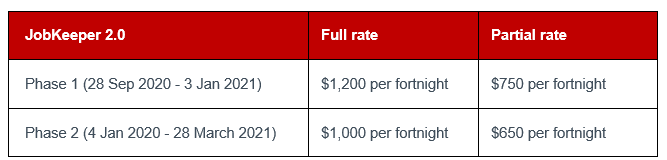

The extended JobKeeper will be notionally divided into Phase 1 (28 September 2020 to 3 January 2021) and Phase 2 (4 January 2021 to 28 March 2021).

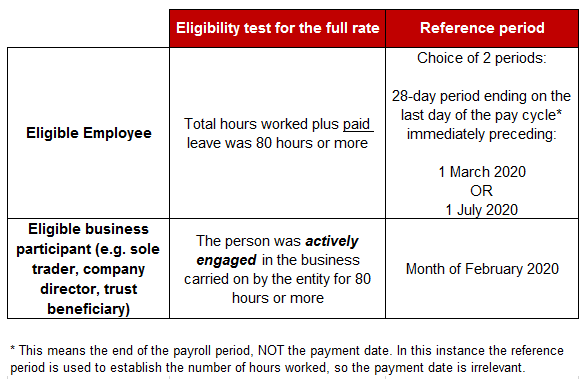

The payment rates will be reduced under each phase from the current $1,500 per fortnight per eligible employee rate and, depending on the hours worked by eligible employees during the "reference period" in February 2020, they may be eligible for either the full or the partial rate:

To determine whether the full or the partial rate will apply, businesses will need to consider the actual hours worked and/or taken as paid leave (in the case of eligible employees) or actual hours of being actively engaged in the business (in the case of eligible business participants - i.e. sole traders or individuals running a business via a partnership, trust or company) during the reference period in February 2020.

Reference period for the 80 hour test

The key points to note here:

- The employer can choose the most beneficial reference period - 1 March or 1 July - in order to test each employee's hours worked. However, for some employees, only one period will be available, e.g. where an employee was hired after 1 March and before 1 July.

- The appropriate reference period is determined on an employee by employee basis and the employer does not have to use the same reference period for all employees. Some employees can use the pay cycle just before 1 March to qualify for the higher rate, and others the pay cycle just before 1 July.

- If your pay cycle doesn't lend itself to aligning with a 28 day period, e.g. you payroll runs monthly, then an apportionment of the total hours worked in that month by the employee will be required to bring it back to the 28 day figure. E.g. 140 hours worked in a 31 day pay period will be apportioned: 140 x 28/31 = 126.5 hours.

- You only need to test each employees' hours once, and report to the ATO for which tier each employee qualifies.

- Eligible business participants will need to notify the entity through which JobKeeper is being claimed, that they have met the 80 hours of active engagement test. If the entity is a sole trader, the notification will need to be given to the ATO.

- Modified reference periods may be available in limited circumstances:

- The hours worked in the reference period are not representative of the employee's hours in a typical 28-day period. In this instance, the employer would need to look at the total hours worked in the most recent pay cycle preceding 1 March or 1 July when the hours worked were representative of a typical 28-day period.

- Employee was not employed during all or part of the reference period; or employees who started employment prior to 1 March or 1 July, but their first pay cycle ended after those dates; or the business changed hands and the employee's reference period was worked with the previous employer and therefore doesn't count. In all these situations, the appropriate reference period will be the first 28-day period ending on or after 1 March or 1 July that wholly occurs during consecutive pay cycles.

- Similarly to the above, alternative reference periods may be available to eligible business participants whose hours of active engagement during February 2020 were atypical (look at the most recent 29-day period ending before 1 March 2020 when the hours of active engagement were typical), or where their engagement in the business commenced partway through February (consider instead a 29-day period starting on the day the individual first began to be a sole trader, partner, beneficiary, shareholder or director of the entity).

- Additionally, if the eligible business participant's business was conducted in a declared drought zone or in a declared natural disaster zone during February 2020, an alternative reference period may be available (the most recent 29-day period wholly within a calendar month ending before 1 March 2020 in which the entity did not conduct business in a declared drought or natural disaster zone).

- If you wish to rely on a modified reference period in relation to the hours of work, or hours of active engagement, please contact us to discuss so that we can make sure that all the necessary conditions are met.

- In some instances, hours worked will not be readily ascertainable (e.g. no complete payroll records available, employees are paid piece rate and not hourly rate) and if certain conditions are met, the ATO will accept that these employees can receive the higher JobKeeper amount. We expect that it will be rare that this discretion will be available. Further details are available in the Legislative Instrument released by the ATO on 16 September.

Note: prior to the JobKeeper 2.0 Rules being released on 15 September, the Treasury factsheet referred to "20 hours or more a week on average" being the determining factor in identifying the applicable JobKeeper 2.0 payment tier. This concept is no longer relevant as this was not how the legislation was drafted. What matters now is whether an employee has actually worked at least 80 hours during the reference period, or whether an eligible business participant was actively engaged in the business for at least 80 hours during the reference period.

WHAT THIS MEANS:

- The number of work hours will have no impact on JobKeeper Payments up to 27 September 2020.

- From 28 September 2020, employees whose work hours decreased from 80 hours or more over a 28-day reference period to fewer than 80 hours over a 28-day period subsequently, will still remain entitled to the full payment rate regardless of the hours they actually work.

- From 28 September 2020, business participants who, in February 2020, were actively engaged in their business for fewer than 80 hours but have since increased their active participation due to the crisis will not qualify for the full payment rate regardless of how many hours they work in their business now.

What does "actively engaged in the business" mean?

This is only relevant to eligible business participants, i.e. sole traders, partners in a partnership, company directors or shareholders, or trust beneficiaries, who are not employees of the business entity.

The term "actively engaged" is not defined in legislation and we must rely on the ATO interpretation:

An individual will be actively engaged in the business carried on by the entity if they regularly:

- perform, or manage the performance of, services the business provides

- sell or manage the sale of goods of the business

- perform other activities associated with managing the business

- exercise control over activities related to business strategy and growth.

An individual will not be actively engaged in the business simply because they:

- own an interest in the business or invest capital in it

- provide advice or other assistance to the business from time to time.

What you need to do

If you were eligible for JobKeeper 1.0 but will not be eligible for JobKeeper 2.0 based on the September 2020 quarter results, you do not need to do anything to leave the system. You will be able to re-enter for Phase 2 if you meet the decline in turnover test for the December 2020 quarter.

If you are enrolled in JobKeeper 1.0, and will continue to be eligible for JobKeeper 2.0, you don't need to re-enroll. You don’t need to reassess employee eligibility or ask employees to agree to be nominated by you as their eligible employer if you are already claiming for them before 28 September.

From 28 September 2020, you must do all of the following:

- work out if the tier 1 or tier 2 rate applies to each of your eligible employees and/or eligible business participants

- notify the ATO and your eligible employees and/or eligible business participants what payment rate applies to them

- during JobKeeper Phase 1 – ensure your eligible employees are paid at least

- $1,200 per fortnight for tier 1 employees

- $750 per fortnight for tier 2 employees

- during JobKeeper Phase 2 – ensure your eligible employees are paid at least

- $1,000 per fortnight for tier 1 employees

- $650 per fortnight for tier 2 employees.

IMPORTANT: If you are registered for GST and have outstanding BAS statements, you should lodge your BAS for the September 2019 and December 2019 quarters as soon as possible (or for equivalent months, if you report monthly). Unlodged BAS statements may hold up your application for JobKeeper Payments under the JobKeeper extension.

We expect the ATO to publish more details about the forms and reporting required under JobKeeper 2.0 in the coming days. The ATO is maintaining a record of updates as they release new information on their website and we recommend keeping an eye on these. You may also wish to review the ATO's page listing key JobKeeper dates.

We will continue to update our COVID-19 Info Hub and in particular our Breaking News page as further details emerge.

As always, we are here to assist you with any JobKeeper questions you may have and encourage you to get in touch with your Ruddicks adviser if you wish to discuss any issues raised in this article.

DISCLAIMER:

Liability limited by a scheme approved under Professional Standards Legislation.

The content of this newsletter is general in nature. It does not constitute specific advice and readers are encouraged to consult their Ruddicks adviser on any matters of interest. Ruddicks accepts no liability for errors or omissions, or for any loss or damage suffered as a result of any person acting without such advice. This information is current as at 24 September 2020, and was published around that time. Ruddicks particularly accepts no obligation or responsibility for updating this publication for events, including changes to the law, the Australian Taxation Office’s interpretation of the law, or Government announcements arising after that time.

Any advice provided is not ‘financial product advice’ as defined by the Corporations Act. Ruddicks is not licensed to provide financial product advice and taxation is only one of the matters that you need to consider when making a decision on a financial product. You should consider seeking advice from an Australian Financial Services licensee before making any decisions in relation to a financial product. © Ruddicks 2020