PAYGW Relief (Cashflow Boost)

Credit for PAYG withheld – measures extended by announcement on 22 March 2020

UPDATE 30 July 2020: The ATO has released a Cashflow Boost Estimator which you can download here.

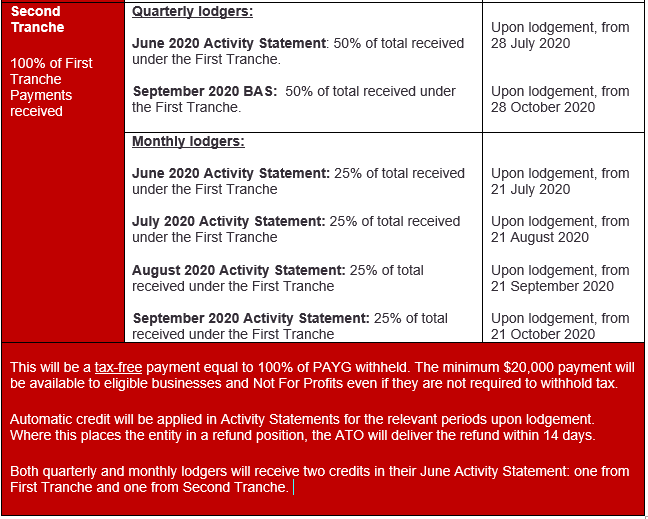

Small to medium businesses (defined as having aggregated turnover of less than $50m) and not-for-profits (including charities) that pay wages will receive a credit in their Activity Statements between $20,000 and $100,000 for the January to September 2020 period to help with the cashflow. If these credits result in a refund position for the Activity Statement, the ATO will deliver the refund within 14 days.

Eligible entities:

- Small to medium business entities that meet all the following criteria:

- aggregated turnover of up to $50m for the most recent income year of the entity that has been assessed by the ATO

- pay salaries, wages, directors fees or similar remuneration which is subject to PAYG withholding even if no tax is actually withheld

- had an ABN as at 12 March 2020

- derived assessable income from carrying on a business during the 2019 income year (as evidenced by tax returns) or generated income in the course of an enterprise between 1 July 2018 and 12 March 2020 (as evidenced by Activity Statements)

- satisfies the new integrity rule that requires that the entity (or an associate or agent of the entity) has not engaged in a scheme for the sole or dominant purpose of seeking to make the entity entitled to these payments or to increase the amount of the entitlement.

- Not For Profits (NFPs) including charities that meet the following criteria:

- aggregated turnover of up to $50m for the most recent income year of the entity that has been assessed by the ATO OR the Commissioner of Taxation is reasonably satisfied that it is likely that the entity is a charity or other not-for-profit entity of equivalent size

- pays salaries, wages, directors fees or similar remuneration which is subject to PAYG withholding even if no tax is actually withheld

- satisfies the new integrity rule that requires that the entity (or an associate or agent of the entity) has not engaged in a scheme for the sole or dominant purpose of seeking to make the entity entitled to these payments or to increase the amount of the entitlement.

The credits and refunds - up to $100,000

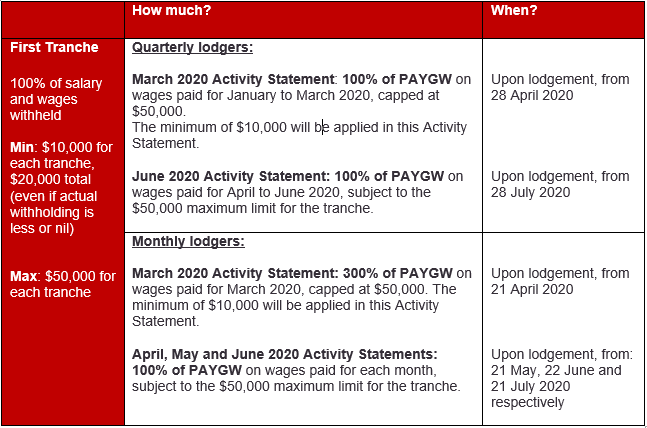

These measures are conceptually simple: broadly, they give employers a credit for PAYGW on wages for the period from January to June 2020 (we are calling this the First Tranche), then employers are given the exact same amount of credit again (‘Second Tranche’), with the payments being subject to a minimum of $20,000 and a maximum of $100,000 in total across both tranches.

The complexity arises from the logistics of delivering these credits via the Activity Statement system, differences between quarterly and monthly lodgers, and multiple due dates. We have therefore summarised the all the details in the following table.

IMPORTANT! BEWARE OF THE INTEGRITY RULE.

The ATO has now released the following information to clarify how they will administer it.

You will not be eligible for cash flow boosts if you (or a representative) have entered into or carried out a scheme for the purpose of:

- becoming entitled to cash flow boosts when you would otherwise not be entitled, or

- increasing the amount of the cash flow boosts.

This may include restructuring your business or the way you usually pay your workers to fall within the eligibility criteria, as well as increasing wages paid in a particular month to maximise the cash flow boost amount.

Any sudden changes to the characterisation of payments made may cause us to investigate whether the payments are in fact wages. If the payments are wages, we may consider the characterisation of past payments, including whether they should have been subject to PAYGW and whether super guarantee contributions should have been made. You may also have FBT obligations that have not yet been met.

We urge you to consult with us if you have significant variations in wages disclosed for the March month or quarter compared to previous periods.

OUR TIPS:

We strongly recommend that you contact us to review the calculations and disclosure of wages and PAYG withholding in your Activity Statements to ensure that you receive the correct stimulus entitlement.

TO DO NOW: If you are a small to medium employer and are behind on your activity statement lodgements, now is the time to catch up! Get your activity statements obligations up to date to ensure you get your payment.

The Treasury has provided a fact sheet which contains examples of how this measure will operate for different types of employer businesses, which you may access here.

DISCLAIMER:

Liability limited by a scheme approved under Professional Standards Legislation.

The content of this newsletter is general in nature. It does not constitute specific advice and readers are encouraged to consult their Ruddicks adviser on any matters of interest. Ruddicks accepts no liability for errors or omissions, or for any loss or damage suffered as a result of any person acting without such advice. This information is current as at 25 March 2020, and was published around that time. Ruddicks particularly accepts no obligation or responsibility for updating this publication for events, including changes to the law, the Australian Taxation Office’s interpretation of the law, or Government announcements arising after that time.

Any advice provided is not ‘financial product advice’ as defined by the Corporations Act. Ruddicks is not licensed to provide financial product advice and taxation is only one of the matters that you need to consider when making a decision on a financial product. You should consider seeking advice from an Australian Financial Services licensee before making any decisions in relation to a financial product. © Ruddicks 2020