Client Information Bulletin April 2010

Extension of Land Tax Rebate Deadline

The Treasurer has this week announced an extension to the deadline for the Business Land Tax Rebate. The deadline for the rebate will be extended until 21 May 2010. Additional time has been provided to ensure that eligible businesses apply for the rebate.

All eligible businesses should immediately submit their applications to the State Revenue Office, including the associated Statutory Declaration.

Owners that do not successfully apply for the rebate will be required to pay the full amount of their 2009-10 and tax bill.

The rebate is available for taxpayers who have eligible business land holdings with a total taxable assessed and value of greater than $350,000.

Application forms and information on how to apply are on the State Revenue Office website www.sro.tas.gov.au.

Eligible applicants should contact the State Revenue Office Land Tax Rebate Hotline on (03) 6233 8070 as soon as possible if they require assistance with the application process.

Ruddicks has prepared a number of applications on behalf of clients and we are happy to assist.

ATO processing delays

This is an update for our clients regarding the IT “Change Program” initiated by the Australian Taxation Office during January 2010.

The Change Program has left many of you without your tax refunds for periods of up to three months. Whilst the Australian Taxation Office are paying compensation by way of interest where your return has been delayed for more than 30 days, this is cold comfort to some.

Wherever possible we have followed up with the Australian Taxation Office on your behalf to ensure that your refunds have not been “lost” in the new system. A number of long outstanding refunds are just starting to flow through now.

Curiously, debit assessments (ie where you owe the ATO money) invariably seem to have been processed much more quickly than refunds!

As a consequence of the delays, which have recently received considerate coverage in both the financial and mainstream press, the Assistant Treasurer, Senator Nick Sherry, has announced that he has asked the Inspector General of Taxation to carry out an investigation of the implementation of the Australian Taxation Office Change Program and its impact. We can only hope that this review will mean that future changes can be streamlined.

ATO attack on Trusts & unpaid present entitlements continues

The following article is highly relevant to those clients with family trusts that distribute income to one or more companies.

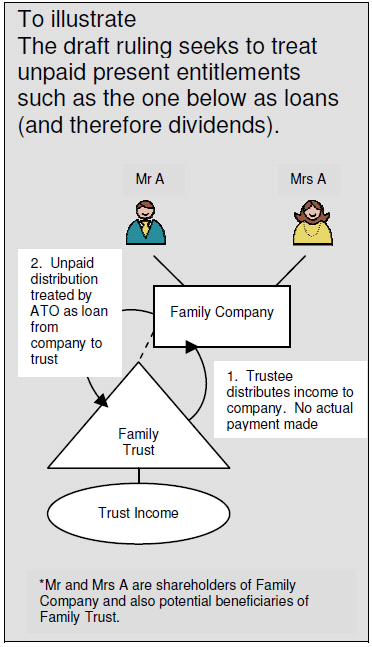

In December 2009, the ATO released a draft ruling (TR 2009/D8) outlining how “Division 7A” of the income tax legislation should apply to private companies with an unpaid present entitlement from a trust (ie a distribution of income made by the trustees to a company that has not been paid out by the trust).

Given the extensive consultations between the professional bodies and the ATO on this issue last year, the professional bodies were surprised by the content of the draft ruling released by the ATO in December. The professional bodies have prepared submissions in relation to the draft ruling, vehemently disagreeing with much of its content.

The draft ruling outlines when the ATO considers that an unpaid present entitlement should be treated as a loan. A consequence of treating an unpaid present entitlement as a loan under Division 7A is often disastrous - unless the loan satisfies certain requirements, it will be treated as a deemed unfranked dividend for tax purposes.

Division 7A – background

Division 7A is an anti-avoidance measure designed to ensure that private companies are not able to distribute profits to shareholders by way of tax free non-arm’s length payments or loans rather than as taxable dividends.

Where Division 7A applies, such payments and loans are treated as unfranked dividends in the hands of the shareholders.

Draft ruling

The draft ruling is concerned about when a private company will be taken to have made a "loan" to a shareholder for the purposes of Division 7A.

More specifically, the draft ruling is concerned about the situation where:

- a private company has a present entitlement to an amount of income from a related trust (ie it can call for immediate payment of the amount by the trust);

- the amount remains in the trust rather than being distributed to the private company (ie there is a present entitlement but it is not paid to the company); and

- the amount is used by the trust for its own purposes or intermingled with other trust funds.

The draft ruling provides that there will be a Division 7A loan in the above circumstances.

The draft ruling states that there may be a loan (by way of financial accommodation) where a private company authorises (including by acquiescence with knowledge) the continued use by the trust of funds representing the company’s unpaid present entitlement by not calling for:

- the payment of that unpaid present entitlement; or

- the investment of the funds representing the unpaid present entitlement for the company’s absolute benefit (as opposed to the funds being intermingled with the trust’s other funds).

The draft ruling gives no guidance on the question of when an unpaid distribution becomes a loan under Division 7A.

The proposed treatment is a complete backflip from numerous public reassurances made by the ATO over the last 12 years that Division 7A would not apply in such circumstances. We expect a final ruling to be issued by June 2010, in time to assist in determining how trust income should be distributed in the 2009/10 financial year.

Personal use of private company assets

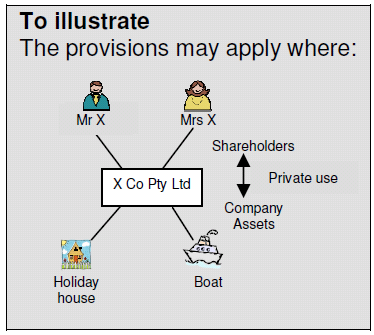

In the 2009/10 Federal Budget, the Government announced its intention to tighten the rules relating to the taxation of benefits provided by a private company to its shareholders or their associates through the use of “lifestyle” assets (eg cars, boats, holiday houses, hobby farms).

A Bill has now been introduced to implement the proposed changes to Division 7A.

The Bill removes the scope for private companies to allow company assets – such as real estate, cars and boats – to be used for free, or at less than their arm's length value, without paying tax.

Under the current Division 7A, certain payments and loans by private companies to their shareholders are treated as deemed dividends.

Under the new legislation the definition of "payment" will be expanded so that it includes a lease, licence or right to use company assets.

This means that any use of a company-owned car, holiday house, unit of accommodation, boat or other asset by shareholders of the company for private purposes could fall foul of Division 7A.

The changes are proposed to apply from 1 July 2009. Certain limited exceptions will apply – eg residences on farming properties.

Superannuation – concessional contributions cap

From 1 July 2009, the concessional contributions cap has been reduced from $50,000 to $25,000 per person. Further, the transitional concessional contributions cap until 30 June 2012 for persons aged 50 or over has been reduced from $100,000 to $50,000.

This is likely to have an adverse impact on the ability of many Australians to save for their retirement.

Under the current taxation regime, concessional contributions are initially subject to 15% tax and non-concessional contributions 0% tax when received by a complying superannuation fund.

If the level of contributions exceeds either the concessional cap, non-concessional cap or both, then the relevant fund member is subject to excess contributions tax as follows:

- The amount of concessional contributions in excess of the concessional contributions cap is subject to penalty tax at the rate of 31.5%. This excess then also counts towards the non-concessional contributions cap.

- The amount of non-concessional contributions in excess of the non-concessional contributions cap is subject to penalty tax at the rate of 46.5%.

Areas of concern

The first area of concern is where a member is already close to both the concessional contributions cap and also the non-concessional contributions cap.

This could occur where the person has more than one position of employment and has salary sacrificed to the $25,000 limit with one position and then is subject to compulsory superannuation guarantee contributions with one or more other positions.

The person may have also contributed close to the non-concessional cap amount (being currently $150,000 p.a. or $450,000 if the person is 65 years or younger and the three year average rule is utilised).

This might be as a result of contributing funds available from an inheritance or investment.

The additional superannuation guarantee amounts may be subject to a total tax of 93% (ie the initial 15% tax on contributions at the superannuation fund level, plus a personal excess concessional contributions tax of 31.5%, plus a personal excess non-concessional contributions tax of 46.5%).

The second area of concern is simply where the new concessional contributions cap of $25,000 is inadvertently exceeded as a result of a person having employer contributions in excess of this amount.

This could occur if there are two or more unrelated employers meeting their respective superannuation guarantee responsibilities in respect of the person, pre existing salary sacrifice arrangements and/or fixed contribution arrangements to meet the cost of ancillary benefits such as death and permanent disablement insurance.

As a result the member might be subject to penalty tax of 31.5% as a result of matters largely outside their control.

Self Managed Super Funds (SMSFs) – on the ATO radar?

The ATO is conducting audits of SMSFs at present.

Recently, the ATO has released various literature regarding SMSFs. Taxpayers should be aware of this material and the possible implications for their SMSF.

The hot topics on the ATO’s radar at the moment include:

- PAYG obligations – where a benefit is paid, SMSFs may have PAYG withholding obligations. SMSFs do not have to withhold from all payments. However, if the SMSF fails to withhold where it is required to do so, penalties may be imposed.

- Related party agreements – SMSFs need to be aware of the “in-house assets” rule which may be breached where SMSFs enter into arrangements (eg investments or loans) with related parties. If the SMSF breaches the in-house assets rule, the fund may become non-complying, with disastrous tax consequences.

- Use of negotiable instruments (eg promissory notes, cheques to pay contributions) – the ATO is targeting the non-commercial use of negotiable instruments in transactions involving SMSFs (eg using a promissory note or cheque without intending to exchange money or assets). The ATO is concerned that SMSFs may be using such instruments to avoid liquidating assets, to change the timing of transactions or obtain tax advantages.

- Unpaid trust distributions – the ATO has issued a ruling in relation to whether an SMSF breaches the superannuation laws where it is entitled to distributions from a related trust but it has not received the payments. The ATO’s ruling examines whether the in-house assets rule, arm’s length rule and / or sole purpose test will be breached by such arrangements.

- Enduring powers of attorney – the ATO has issued a tax ruling in relation to the requirements to remain an SMSF if an enduring power of attorney is executed.

Small business entities – what concessions are available?

With tax time coming, it might be worthwhile revisiting whether your business is entitled to any small business concessions.

Small businesses with an annual turnover of less than $2 million may be eligible for a range of tax concessions, including the following:

- small business tax break;

- capital gains tax (CGT) exemption for assets you have held for at least 15 years;

- CGT 50 per cent active asset reduction;

- CGT retirement exemption;

- CGT roll-over for replacement assets;

- simpler depreciation rules (ie generally assets can be “pooled” for the purposes of determining depreciation deductions);

- simpler trading stock rules (ie in certain circumstances you can choose whether or not to do an end-of-year stock take);

- immediate deduction for certain prepaid business expenses;

- the entrepreneurs’ tax offset may reduce your tax payable by up to 25% where your business has a turnover of less than $75,000;

- GST can be accounted for on a cash basis;

- GST input tax credits can be apportioned annually for assets used partly for private and partly for business purposes;

- you may be exempt from FBT for employee car parking; and

- Pay as you go instalments can be paid and worked out based on your business and investment income in your most recently assessed tax return.

Is my business eligible?

A business will qualify for the above concessions if the “aggregated turnover” is less than $2 million.

Your aggregated turnover is the sum of your turnover and the turnover of any entities you are connected or affiliated with.

Turnover includes all income earned in the ordinary course of business.