Depreciation of plant & equipment in residential rental properties

This change will affect those investors who purchase second-hand residential properties after 7:30 pm on 9 May 2017 by limiting the depreciation they can claim on “previously used” plant and equipment assets (i.e. those already installed on the property at the time of purchase and included in the purchase price). For the affected properties, the only depreciation deductions allowed from 1 July 2017 will be those related to assets actually purchased by the investor. Pre-existing assets included in the purchase of the property will not be depreciable and will instead be added to the cost base of the property for capital gains tax (‘CGT’) purposes, therefore reducing any future capital gain.

Typical examples of plant and equipment for residential properties include whitegoods, heat pumps, hot water cylinders, furnishings, drapes and blinds. These are generally items that are removable and are not considered to be permanently attached to the building. Depreciation deductions for these items can be quite significant, especially for recently constructed or renovated properties.

If you purchased a residential investment property prior to 7:30 pm on 9 May 2017, you can continue to claim depreciation deductions in relation to pre-existing assets you purchased with the property (subject to the usual conditions of it being used to produce assessable income and there being a quantity surveyor’s report identifying the amount of depreciation that can be claimed in respect of each pre-existing asset).

Investors with properties bought at any time, who purchase new assets after 7:30 pm on 9 May 2017 will be able to claim depreciation for those assets under the usual provisions. However, when they sell the property, the subsequent owner will be unable to claim depreciation on the assets purchased by the previous owner.

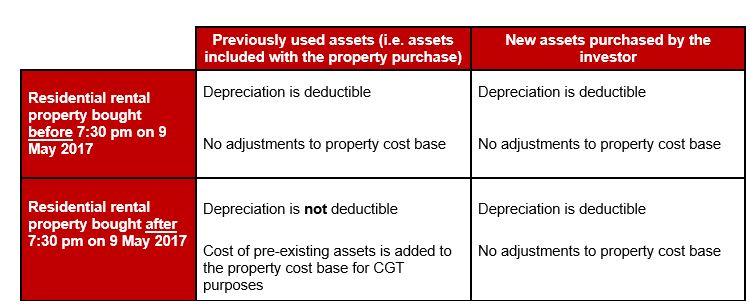

The new regime is summarised in the table below:

Important!

Pre-existing assets also include assets which were bought new but used by the landlord for private purposes (for any period other than occasional use). This will affect those property owners who were intending to rent out their homes in the future. If you purchase your home after 7:30 pm on 9 May 2017 and later rent it out, you may wish to consider taking your chattels with you to your new home, and renting out the former home unfurnished or fitting it out with new assets purchased after you move out.

Examples of occasional use include staying at the property for one evening while carrying out maintenance activities or spending a weekend in a holiday home or allowing relatives to stay for one weekend free of charge in the holiday home that is usually used for rent. To be classified as occasional, property use for personal reasons must be infrequent, minor and irregular.

It is therefore crucial that for rental properties (and in particular holiday homes) purchased after 7:30 pm on 9 May 2017, private use of the properties is carefully managed so as not to lose access to depreciation deductions on the plant and equipment assets installed at the property.

Exclusions from the new regime:

- Qualifying capital works deductions in relation to the structure of the building and assets considered to be permanently fixed to the building (e.g. cabinets, doors, windows, bathtub and toilet). This includes any capital works incurred by the current or the previous owner of the property. Generally, any residential building where construction commenced after 15 September 1987 will entitle their owner to a capital works deduction at a rate of 2.5% for up to 40 years. Renovations to older buildings may also give rise to a capital works deduction.

- Brand new residential premises, regardless of when purchased.

- Properties considered to be substantially renovated by the previous owner for selling purposes (however, if any entity had previously been entitled to depreciation deductions on the new assets, or if someone lived in the property before it was held by the current owner, no depreciation deduction will be available to the current owner in respect of these assets).

- Non-residential/commercial properties.

- Properties owned by certain entities including companies.

- Assets acquired in the course of carrying on a business, such as a property management agency, or large scale investing in residential property.

Developers renting out properties

It is not unusual for developers to temporarily rent out properties they cannot sell within a desired timeframe. However, doing so would deny the purchaser of such a property the ability to claim depreciation on plant and equipment included with the property. This is because these assets would no longer be considered “new” – they would have been used by the developer’s tenants prior to the sale of the property. It is therefore important to be mindful of the property’s history of use, even if buying newly constructed premises.

In relation to “carrying on a business”

It is possible for individuals and trusts to carry on a business of investing in residential property, but you do need to demonstrate that your activities amount to a business. It becomes a question of scale (the more properties, the more likely it is that there is a business being carried on), the nature and regularity of activities and tasks you undertake, the evidence of business-like approach and planning, and other factors.

If you own multiple residential rental properties as an individual, jointly with another person or as a trustee of a trust, and you incur significant travel expenditure in relation to the properties, it would be worthwhile to discuss with your Ruddicks adviser whether your activities can be classified as a business.

Conclusion

While it is unlikely that this measure will resolve the housing affordability crisis, it will however have a significant impact on the after-tax return for investors buying second hand residential rental properties after 7:30 pm on 9 May 2017. Additionally, private use of rental holiday homes will need to be carefully managed so as not to lose access to depreciation deductions in the period following private use.

Important!

There are also changes to deductibility of travel expenses in relation to residential rental properties, effective from 1 July 2017. You can read more about them here.

DISCLAIMER:

Liability limited by a scheme approved under Professional Standards Legislation.

The content of this newsletter is general in nature. It does not constitute specific advice and readers are encouraged to consult their Ruddicks adviser on any matters of interest. Ruddicks accepts no liability for errors or omissions, or for any loss or damage suffered as a result of any person acting without such advice. This information is current as at 1 June 2018, and was published around that time. Ruddicks particularly accepts no obligation or responsibility for updating this publication for events, including changes to the law, the Australian Taxation Office’s interpretation of the law, or Government announcements arising after that time.

Any advice provided is not ‘financial product advice’ as defined by the Corporations Act. Ruddicks is not licensed to provide financial product advice and taxation is only one of the matters that you need to consider when making a decision on a financial product. You should consider seeking advice from an Australian Financial Services licensee before making any decisions in relation to a financial product. © Ruddicks 2018