Federal Budget 2018

Individuals

Personal tax cuts

The Government has announced a seven year Personal Income Tax Plan which will include a number of changes aimed at reducing personal income tax through tax offsets and changes to tax brackets.

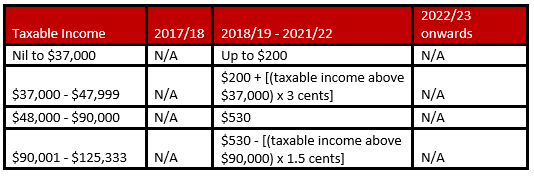

Low and Middle Income Tax Offset

The Government will introduce the Low and Middle Income Tax Offset (‘LAMITO’), a new non-refundable tax offset of up to $530 per year to eligible Australian resident taxpayers. The offset will be available for the 2019 to 2022 income years and will be applied in individual tax returns. It will cut out for those with taxable income above $125,333 per year.

The Low and Middle Income Tax Offset is in addition to the existing Low Income Tax Offset (‘LITO’):

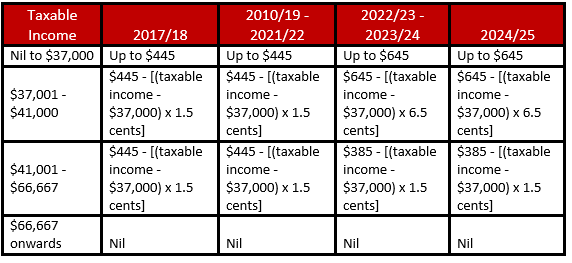

Low Income Tax Offset

From 1 July 2022 the annual Low Income Tax Offset (LITO) will increase to $645 and will cut out for those with a taxable income above $66,667 per year.

Adjustment to tax brackets

Over a seven year period commencing from 1 July 2018 the personal income tax brackets will be revised as illustrated in the table below. After seven years, the current five personal income tax brackets will be reduced to four so that the majority of taxpayers will be on a marginal tax rate of 32.5% or lower. The rates below do not include Medicare Levy.

You can use the income tax calculator at https://budget.gov.au to estimate your tax savings from the proposed Personal Income Tax Plan.

Medicare levy

The Government has announced that it will not proceed with the previously announced increase in the Medicare Levy from 2% to 2.5% of taxable income from 1 July 2019.

Preventing inadvertent concessional superannuation cap breaches by certain employees

From 1 July 2018, the Government will allow individuals whose income exceeds $263,157, and who have multiple employers, to nominate that their wages from certain employers are not subject to the superannuation guarantee (SG). The measure will allow eligible individuals to avoid unintentionally breaching the $25,000 annual concessional contributions cap as a result of multiple compulsory SG contributions. Employees who use this measure could negotiate to receive additional income, which is taxed at marginal tax rates.

Compliance activities targeting individuals and their tax agents

The Government will provide $130.8 million to the ATO from 1 July 2018 to increase compliance activities targeting individual taxpayers and their tax agents.

This measure is a response to specific compliance issues for individual taxpayers previously identified by the ATO including incorrect reporting of foreign source income and over-claiming of work-related and car deductions. The measure will also provide funding for new compliance activities, including additional audits and prosecutions, improving education and guidance materials and pre-filling of income tax returns.

Business

The $20,000 immediate write-off for small business

The Government will extend the $20,000 immediate asset write-off for small businesses with aggregated annual turnover under $10 million for another year to 30 June 2019.

Small businesses will be able to immediately deduct purchases of eligible assets costing less than $20,000 first used or installed ready for use by 30 June 2019. Only a few assets are not eligible (such as capital works, horticultural plants, in-house software and certain lease assets).

Assets valued at $20,000 or more (which cannot be immediately deducted) can continue to be placed into the small business general depreciation pool and depreciated at 15% in the year of purchase and 30% each income year thereafter. The pool can also be immediately deducted if the balance falls below $20,000 during the period to 30 June 2019.

Introduction of a new cash payment limit

From 1 July 2019, the Government will introduce a limit of $10,000 for cash payments made to businesses for goods and services.

This measure is designed to address tax evasion and money laundering and other criminal activity. Transactions over the $10,000 threshold will have to be made through an electronic payment system or cheque and transactions with financial institutions or consumer to consumer non-business transactions will remain unaffected.

No tax deductibility for payments where withholding obligations have not been met

From 1 July 2019, businesses will no longer be able to claim a deduction for the following payments:

- Payments to their employees such as wages where they have not withheld any amount of PAYG from these payments (despite the fact the PAYG withholding requirements apply), and

- Payments made by businesses to contractors where the contractor does not quote their ABN and the business does not withhold any amount of PAYG (despite the withholding requirements applying).

Expanding the contractor payment reporting system

The contractor payment reporting system which was first introduced for the building and construction industry and subsequently extended to the cleaning and courier industries will be further expanded to include the following industries:

- security providers and investigation services;

- road freight transport; and

- computer system design and related services.

Businesses in the above three industries will need to ensure that they collect information about their payments to contractors from 1 July 2019, with the first annual report required in August 2020.

Division 7A changes

The Government will clarify the operation of Division 7A to ensure that unpaid present entitlements (UPEs) to corporate beneficiaries come within the scope of Division 7A. A UPE arises where a related private company becomes entitled to a share of trust income as a beneficiary but has not been paid that amount. This measure will ensure the UPE is either required to be repaid to the private company over time as a complying loan or is subject to tax as a dividend.

Additionally, previously announced measures introducing improvements to the operation of Division 7A have been delayed for 12 months to 1 July 2019. These included:

- a self-correction mechanism for inadvertent breaches of Division 7A;

- appropriate safe-harbour rules to provide certainty;

- simplified Division 7A loan arrangements; and

- a number of technical adjustments to improve the operation of Division 7A and provide increased certainty for taxpayers.

Director Penalty Regime expanded to combat illegal ‘phoenixing’ activities

The Government will reform the corporations and tax laws to address illegal phoenix activity, including the extension of the Director Penalty Regime to GST, luxury car tax and wine equalisation tax, making company directors personally liable for the company’s debts. Currently, the Director Penalty Regime applies only to unpaid PAYG Withholding and superannuation guarantee amounts.

Additional measures which will be introduced to tackle ‘phoenixing’ include:

- increasing the ATO’s power to retain refunds where there are outstanding tax lodgements;

- introducing new phoenix offences to target those who conduct or facilitate illegal phoenixing;

- preventing directors from improperly backdating resignations to avoid liability or prosecution;

- limiting the ability of directors to resign when this would leave the company with no directors; and

- restricting the ability of related creditors to vote on the appointment, removal or replacement of an external administrator.

Research & Development Tax Incentive changes

The Government will amend the Research and Development (R&D) Tax Incentive with effect from 1 July 2018 in order to target this concession better.

For companies with annual group turnover below $20million, the R&D Tax Incentive will remain a refundable offset but at a reduced rate of 41%, down from 43.5% of eligible expenditure for the 2018/19 and subsequent income years. The reduced rate still provides a net additional benefit of 13.5% of eligible R &D expenditure. Additionally, cash refunds from the R&D offset will be capped at $4 million per year. The excess above the $4 million cap will be carried forward as a non-refundable tax offset to future income years. R&D expenditure on clinical trials will not count towards this cap.

For companies with aggregated annual group turnover of $20 million or higher, the Government will introduce an R&D premium that ties the rates of the non-refundable R&D tax offset to the incremental intensity of R&D expenditure as a proportion of total expenditure for the year. Additionally, the R&D expenditure threshold which limits the amount of expenditure eligible for the R&D tax offset will be increased from $100 million to $150 million per year for these large companies.

Testamentary Trusts

From 1 July 2019, the concessional tax rates available for minors receiving income from testamentary trusts will be limited to income derived from assets that are transferred from the deceased estate or the proceeds of the disposal or investment of those assets.

Currently, some taxpayers are able to obtain the benefit of these concessional tax rates by transferring assets unrelated to the deceased estate into the testamentary trusts. This measure will clarify that minors will be taxed at concessional marginal tax rates only in respect of income a testamentary trust generates from assets of the deceased estate or the proceeds of the disposal or investment of these assets.

Superannuation

Work test exemption

From 1 July 2019 the Government will introduce a one-off exemption from the work test for voluntary contributions to superannuation, which will be available for retirees aged 65-74 with superannuation balances below $300,000, and only in the first financial year that they do not meet the work test.

The exemption will only be available for 12 months from the end of the financial year in which the retiree last met the work test.

The work test currently requires individuals who are 65-74 to have worked at least 40 hours within 30 consecutive days in a financial year before they can make a personal contribution to superannuation.

Increasing the maximum number of members in SMSFs

From 1 July 2019, the maximum number of members allowable in new or existing self-managed superannuation funds (‘SMSF’) or small APRA funds will increase from four to six.

Three yearly audit requirement for some SMSFs

From 1 July 2019, the requirement for annual audits will be changed to a three yearly requirement for SMSFs with a good compliance record. To be eligible, SMSFs will need to have three consecutive years of clear audit reports and must have lodged all returns over that period on time.

It is currently unclear whether the 2020 financial year will be the first year an audit exemption will be available. We expect that a consultation process will be required to determine appropriate audit procedures for the proposed three yearly audits. This measure is aimed at reducing compliance costs and the regulatory burden for SMSF trustees who consistently do the right thing and comply with superannuation and tax law requirements.

Reducing fees and reuniting ‘lost’ superannuation accounts

From 1 July 2019, the Government will introduce a 3% annual cap on passive fees charged by superannuation funds on accounts with balances below $6,000 and will ban exit fees on all superannuation accounts.

The Government will also require the transfer of all inactive superannuation accounts with balances below $6,000 to the ATO. In turn, the ATO will expand its data matching capabilities to proactively reunite these inactive superannuation accounts with the member’s active account, where possible.

Insurance in superannuation funds

From 1 July 2019 insurance within superannuation will move from a default framework to be offered on an opt-in basis for members:

- with balances of less than $6,000

- under the age of 25, and

- whose accounts have not received a contribution in 13 months and are deemed inactive.

Property & real estate

Deductions denied for vacant land

From 1 July 2019, the Government will deny deductions for expenses associated with holding vacant residential or commercial land, including council rates and interest costs incurred to fund the purchase of the land. This measure is designed to discourage land owners from holding vacant land, commonly known as ‘land banking’, amid concerns that deductions are being improperly claimed for land that is not being genuinely held for the purposes of producing assessable income.

Deductions for expenses associated with holding the land will be available once a property has been constructed on the land, it has received approval to be occupied and is available for rent.

Denied deductions will not be able to be carried forward for use in later income years, however, denied deductions may be included in the cost base of the land.

This proposed measure is intended to apply to all entities (e.g., individuals, trusts, companies) however an exclusion applies for vacant land that is held by an entity that is using the land to carry on a business, including a business of primary production.

Please contact your Ruddicks adviser if you have any questions about the proposed measures discussed in this newsletter or if you require any further information.

DISCLAIMER:

Liability limited by a scheme approved under Professional Standards Legislation.

The contents of this publication are general in nature and we accept no responsibility for persons acting on information contained herein. The content of this newsletter does not constitute specific advice and readers are encouraged to consult their Ruddicks adviser on any matters of interest.

Any advice provided is not ‘financial product advice’ as defined by the Corporations Act. Ruddicks is not licensed to provide financial product advice and taxation is only one of the matters that you need to consider when making a decision on a financial product. You should consider seeking advice from an Australian Financial Services licensee before making any decisions in relation to a financial product. © Ruddicks 2018