Federal Budget Bulletin May 2013

The Budget relies upon 3 major planks for support:

1. The continuation of significant deficit in 2013/14 ($18b) and 2014/15 ($10.9b) before reaching a small surplus in 2015/16.

2. Targeting business taxes, mainly at the big end of town with particular emphasis on tax minimisation by multinationals, removal of the deductibility of exploration expenses and abolishing research and development tax incentives for large entities. Also included is a timing difference in tax payments for large entities to bring them into monthly pay as you go tax instalments.

3. Removing some of what have been described as “middle class welfare payments” - more particularly the removal of the baby bonus with some offsetting adjustment to the Family Tax Benefit Part A. Also abandoned were some of the promised increases to these welfare payments.

There appears to be few changes to the taxation legislation at the small to medium business level apart from superannuation changes that were forecast 6 weeks ago.

It would appear the Budget is framed within the stark reality of an election where the incumbent government has diminished hope of returning to power. It nonetheless challenges the Opposition to disclose their financial support of the big ticket reforms to National Disability and school funding and their approach to managing “middle class welfare”.

It is still uncertain as to whether the controversial measures will ever become law given the few weeks left that Parliament has to sit before the election. Political commentators appear divided on this matter.

To the relief of many, at least in one area there have been no new major changes announced – superannuation. The Government has however reaffirmed its commitment to the measures announced on 5 April, which we analysed in our Superannuation Bulletin in April 2013. This Bulletin is available for download on our website at your convenience.

Personal Tax Measures

Personal income tax rates for 2014, 2015 and 2016 years

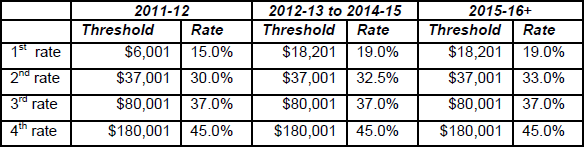

Personal income tax rate cuts that had been already legislated (by way of increasing the tax-free threshold) and due to commence on 1 July 2015 will be deferred. The Government has stated that this is due to the projected fall in the price of carbon from $25.40 in 2015 to $12.10 in 2016. Accordingly personal tax rates will be as follows:

Medicare levy to be increased to help fund National Disability Insurance Scheme (NDIS)

On 1 May 2013 the Prime Minister announced that the Government will increase the Medicare levy from 1.5% to 2% of taxable income from 1 July 2014 in order to fund the NDIS, declared to be “Australia’s most fundamental social policy since Medicare”.

All funds raised by the levy are to go directly into the dedicated special account of DisabilityCare Australia, which will only be drawn down to meet expenditure directly related to DisabilityCare.

Medicare levy is payable by all resident taxpayers, with phase-in thresholds applicable to low income earners and seniors.

Reforms to self-education expense deductions

On 13 April 2013, the government announced a proposal to introduce a $2,000 per person cap on all work-related self-education expenses from 1 July 2014. The Budget provided further details about this measure which will apply to expenses such as conferences, workshops, tuition fees, travel and accommodation. There is currently no cap on the self-education expenses that can be claimed, provided they meet certain eligibility criteria.

The government has confirmed that employers are currently not liable for fringe benefits tax (FBT) for education and training they provide to their employees - this treatment will be retained, unless an employee enters into a salary sacrifice arrangement for work-related education expenses.

Net medical expenses (NME) tax offset to be phased out

From 1 July 2013, only those taxpayers who are able to claim the NME tax offset in the current 2013 income year will continue to be eligible for the offset in the 2014 income year. Similarly, only those who claim the NME tax offset in the 2014 income year will continue to be eligible for the offset in the 2015 income year.

This effectively means that if you are unable to claim the NME tax offset in the current year, you lose your eligibility for the tax offset in the 2014 and 2015 years. It is therefore important to recap on the 2013 NME eligibility criteria:

- You, your spouse and your dependent children (under 21) have combined out of pocket eligible medical expenses (i.e. not reimbursed by Medicare or your private health insurer) above the relevant threshold, depending on your family income;

- The relevant threshold for singles on adjusted taxable income below $84,000 or $168,000 for couples/families is $2,120 and the maximum rebate is 20% of amount exceeding the threshold;

- The relevant threshold for singles on adjusted taxable income above $84,000 or $168,000 for couples/families is $5,000 and the maximum rebate is 10% of amount exceeding the threshold*;

- The family income test is increased by $1,500 for each dependent child after the first regardless of the family income;

- The adjusted taxable income includes such amounts as adjusted fringe benefits, reportable super contributions (i.e. salary sacrifice and deductible personal contributions by the self-employed) and investment/rental property losses are added back.

*Subject to the previously announced measures being legislated.

Eligible medical expenses include payments:

- to dentists, orthodontists or registered dental mechanics

- to opticians or optometrists, including for the cost of prescription spectacles or contact lenses

- to a carer who looks after a person who is blind or permanently confined to a bed or wheelchair

- for therapeutic treatment under the direction of a doctor

- for medical aids prescribed by a doctor

- for artificial limbs or eyes and hearing aids, adhesive plaster and strapping, neoprene bandages, wheelchairs, crutches, spinal and surgical braces, surgical shoes and boots, oxygen equipment, kidney dialysis units (including plumbing connections), colostomy appliances, invalid chairs and tricycles, car controls for the disabled, teletypewriters, Maximyst machines (for asthma sufferers), hearing aids and Auditory Trainers (very powerful hearing aids)

- for maintaining a properly trained dog for guiding or assisting people with a disability (but not for social therapy)

- for laser eye surgery, and

- for treatment under an in-vitro fertilisation program.

You may therefore wish to bring forward some discretionary medical expenditure (e.g. dental or optical) to the current financial year ending 30 June 2013, in order to help retain your eligibility for the medical expenses rebate in the following two income years.

The NME tax offset will continue to be available for taxpayers for out of pocket medical expenses relating to disability aids, attendant care or aged care expenses until 1 July 2019.

HECS-HELP discount and voluntary HELP repayment bonus: discounts to end

From 1 January 2014 the following discounts relating to the Higher Education Loan Program will be removed:

- the 10% discount available to students electing to pay their student contribution up-front, and

- the 5% bonus on voluntary payments made to the Tax Office of $500 or more.

Business Tax Measures

Enhancing Farm Management Deposits

From 1 July 2014, Farm Management Deposit scheme eligibility will be opened up as the Government will increase the non-primary production income threshold from $65,000 to $100,000 so that more primary producers will be able to access the scheme. Farm Management Deposits enable primary producers to diversify their income and to manage variations in incomes from year to year.

Mining rights and information to be excluded from immediate exploration deduction

The immediate deduction for the cost of assets first used for exploration will be amended to exclude mining rights and information. This change will address situations where the immediate deduction is being claimed for the costs of acquiring an interest in natural resources that have effectively already been discovered.

Under this measure, mining rights and information first used for exploration will be depreciated over 15 years, or their effective lives, whichever is shorter. The effective life of a mining right and associated exploration information will be the life of the mine that it leads to. If the exploration is unsuccessful, the remaining amount will be written off when this is established.

This measure will apply to taxpayers who start to hold the relevant rights or information after 7:30pm on 14 May 2013.

International Taxation

To prevent multinational enterprises from shifting profits by a disproportionate allocation of debt to Australia the Government are proposing changes to the following international tax regimes:

- Thin capitalisation;

- Foreign non-portfolio equity interests;

- Interest incurred in deriving foreign exempt income; and

- Controlled foreign company rules.

These measures will be effective from 1 July 2014 and it is anticipated that a $1.5bn gain to revenue over the forward estimates period will result from these measures.

Social Security Measures

Housing Help for Seniors

The Government is seeking to remove the disincentive for pensioners to move to a home more appropriate for their needs. This will be accomplished through a trial introduction of a scheme whereby at least 80% of the proceeds from the sale (up to $200,000) will be deposited into a special account. If the family home has been owned for more than 25 years, then these funds (plus interest) will be exempt from the pension means testing for up to 10 years as long as there are no withdrawals from the account.

The pilot will commence on 1 July 2014 and be closed to new customers from 1 July 2017.

Replacing the Baby Bonus with new family payment arrangements

From 1 March 2014 the Baby Bonus of $5,000 per child will be abolished. Instead, Family Tax Benefit Part A (FTB Part A) payments will be increased by $2,000, to be paid in the year following the birth or adoption of a first child or each child in multiple births; $1,000 will be paid for second and subsequent children. The additional FTB Part A will be paid as an initial payment of $500, with the remainder to be paid in seven fortnightly instalments.

Parents who take up Paid Parental Leave (PPL) will not be eligible for the additional FTB Part A component.

Superannuation Measures

Other superannuation details, previously announced, which were recorded within the budget papers include:

- the first of the staged increases in mandatory superannuation guarantee from 9% to 9.25% from 1 July 2013;

- from 1 July 2012 people earning less than $37,000 are eligible for the Low Income Super Contribution which effectively represents the refund of their contributions tax on super guarantee; and

- people with adjusted taxable incomes of more than $300,000 will have their superannuation contributions taxed at 30% instead of 15% from 1 July 2012.

These measures together with the announcements of 5 April 2013 represent the extent of the Government’s proposed changes to superannuation.

Other Measures

Tax Office trusts taskforce

The government will provide $67.9m over four years to the Tax Office to undertake compliance activity in relation to taxpayers who have been involved in egregious tax avoidance and evasion using trust structures.

The Tax Office will target the exploitation of trusts to:

- conceal income

- mischaracterise transactions

- artificially reduce trust income amounts, and

- underpay tax.

SBR, ABR and ABN administration enhanced

The government will provide $80.2m over the forward estimates period to the Tax Office and the Department of Finance and Deregulation to strengthen up-front checks for issuing Australian Business Numbers (ABNs) and encourage the use of AUSkey, which is a secure credential for accessing the online services of the Australian Business Register. These measures are aimed at ensuring that only entities that are genuinely carrying on a business are able to obtain an ABN.

Tobacco excise to be indexed

The price of a packet of cigarettes will rise by about 7 cents from 1 March 2014. Budget papers remained silent on how much revenue this would raise.

Dividend Washing

Currently sophisticated investors can engage in “dividend washing” which in effect enables doubledipping of franking credits. This is outside the intent of the dividend imputation system as such the Government has announced that it will close this loophole. The Government will consult on the development of this legislation, however it is likely to be effected through a change to the 45 day holding period and last-in-first-out rules.

This measure will apply from 1 July 2013, and will only apply to investors that have franking tax offset entitlements in excess of $5,000.

Expanded ATO Data Matching

The Government will provide further funding to the ATO to pursue compliance activities by expanding data matching with third party information. This will cover:

- taxable government grants and specified other government payments;

- sales of real property, shares (including options and warrants), and units in managed funds;

- sales through merchant debit and credit services;

- managed investment trust and partnership distributions, company dividend and interest payments; and

- transactions reported to the ATO by the Australian Transaction Reports and Analysis Centre (AUSTRAC).

Tasmanian Initiatives

NBN

Fibre construction is scheduled to be completed in Tasmania by the end of 2015 and will have a uniform national wholesale price. This will ensure that all Australians, including those in regional areas, have access to competitively priced broadband.

Jobs & Growth for Tasmania

The Government has committed over $330 million to support the Tasmanian Forests Agreement, which it claims provides a long term future for the forestry industry and environmental protection for the forests. Also announced is more than $22 million to support jobs, skills and accelerated investment in key sectors of the Tasmanian Economy.

The Federal Government is also recognising Tasmania’s leading role in Antarctic research and operations by providing over $42 million to support ongoing research and maintenance of our presence in the Antarctic.

Roads

The Government is providing $500 million over ten years through the Nation Building Program towards a package of works to upgrade the Midland Highway.

Disaster Income Recovery Subsidy Payments

As a result of the bushfires in Tasmania earlier this year, DIRS payments were made available for individuals in the local government areas of Sorrell and Tasman, where it can be demonstrated that they have experienced a loss of income as a result of the bushfires in Tasmania. The DIRS provides fortnightly payments for up to 13 weeks equivalent to the maximum rate of Newstart Allowance or Youth Allowance depending on a person's circumstances, for which applications close 7 October 2013.

The Treasurer announced Disaster Income Recovery Subsidy (DIRS) payments provided between 3 January 2013 and 30 September 2013 are to be exempt from income tax.