Federal Budget - October 2020

Personal income tax changes

Personal tax rates cuts

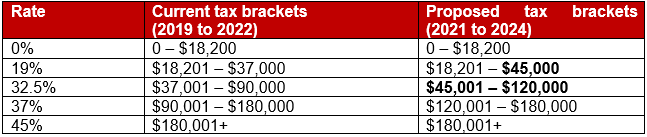

The Government has announced that it will bring forward changes to the personal income tax rates that were due to apply from 1 July 2022, so that these changes now apply from 1 July 2020 (i.e., from the 2021 income year):

- The upper threshold of the 19% personal income tax bracket will increase from $37,000 to $45,000; and

- The upper threshold of the 32.5% personal income tax bracket will increase from $90,000 to $120,000.

These changes are illustrated in the following table (which excludes the 2% Medicare Levy).

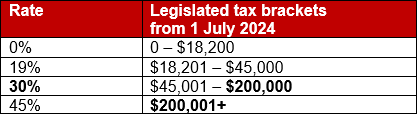

From 1 July 2024, the already legislated tax rate changes will remain unchanged: the 37% tax bracket will disappear, the 32.5% tax rate will reduce to 30% and the corresponding tax bracket will cover incomes up to $200,000:

Low Income Tax Offset (LITO)

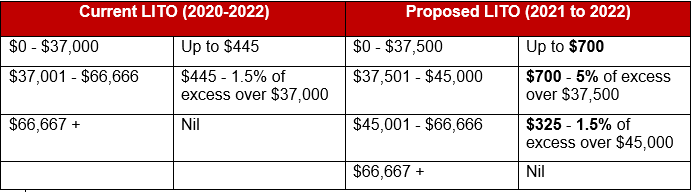

The Government announced that it will also bring forward the changes that were proposed to the LITO from 1 July 2022, so that they will now apply from 1 July 2020 (i.e., from the 2021 income year):

- The maximum LITO will be increased from $445 to $700.

- The increased (maximum) LITO will be reduced at a rate of 5 cents per dollar, for taxable incomes between $37,500 and $45,000.

- The LITO will be reduced at a rate of 1.5 cents per dollar, for taxable incomes between $45,000 and $66,667.

Low and Middle Income Tax Offset (LAMITO)

The Government announced that the current LAMITO would continue to apply for the 2021 income year (which is available in addition to the LITO for eligible taxpayers).

For example, the maximum LAMITO of $1,080 will be available to taxpayers with taxable incomes of between $48,000 and $90,000 in the 2021 income year.

A "Tax Relief Estimator" is available on the Treasury website which provides an estimate of the benefit you may receive from the above measures, based on your taxable income. Please be aware, however, that there are many factors that can influence an individual's ultimate tax outcome and this online tool is designed merely for illustrative purposes.

Business income tax changes

Expanded access to small business concessions

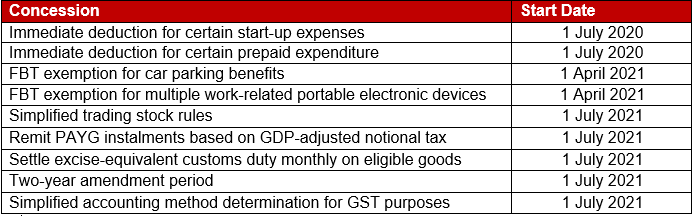

The Government announced that it will expand access to a range of small business tax concessions currently available only to small business entities (defined as having aggregated annual turnover of under $10m) to include medium sized businesses (defined as having aggregated annual turnover of under $50m).

Under the measures, medium sized businesses will gain access to the following 10 small business concessions:

JobMaker Hiring Credit

From 7 October 2020, eligible employers will be able to claim $200 a week for each additional eligible employee they hire aged 16 to 29 years old and $100 a week for each additional eligible employee aged 30 to 35 years old.

New jobs created until 6 October 2021 will attract the credit for up to 12 months from the date the new position is created.

The JobMaker Hiring Credit will be claimed quarterly in arrears by the employer from the ATO from 1 February 2021. Employers will need to report quarterly that they meet the eligibility criteria.

The amount of the credit is capped at $10,400 for each additional new position created and the total credit claimed by an employer cannot exceed the amount of the increase in payroll for the reporting period in question (see employer eligibility requirements below).

Eligible employers

An employer is able to access the JobMaker Hiring Credit if the employer:

- has an ABN;

- is up to date with tax lodgement obligations;

- is registered for Pay As You Go withholding;

- is reporting through Single Touch Payroll;

- is claiming in respect of an ‘eligible employee’ (see below);

- has kept adequate records of the paid hours worked by the employee they are claiming the hiring credit in respect of; and

- is able to demonstrate that the credit is claimed in respect of an additional job that has been created.

Broadly, there must be an increase in the business’ total employee headcount and also in the payroll of the business for the reporting period (based on a comparison over a specified reference period).

Employers do not need to satisfy a fall in turnover test to access the JobMaker Hiring Credit. Certain employers are excluded, including those who are claiming the JobKeeper payment. New employers created after 30 September 2020 are not eligible for the first employee hired but are (potentially) eligible for the second and subsequent eligible hires.

Eligible employees

- Employees may be employed on a permanent, casual or fixed term basis and must:

be aged (i.e., at the time their employment started) either:

– 16 to 29 years old, to attract the payment of $200 per week; or

– 30 to 35 years old to attract the payment of $100 per week; - have worked at least 20 paid hours per week on average for the full weeks they were employed over the reporting period;

- have commenced their employment during the period from 7 October 2020 to 6 October 2021;

- have received the JobSeeker Payment, Youth Allowance (Other), or Parenting Payment for at least one month within the past three months before they were hired; and

- be in their first year of employment with this employer and must be employed for the period that the employer is claiming for them.

Certain exclusions apply, including employees for whom the employer is also receiving a wage subsidy under another Commonwealth program (e.g. JobKeeper).

Unlimited immediate write-off for depreciable assets

The Government has announced the following changes to depreciation provisions:

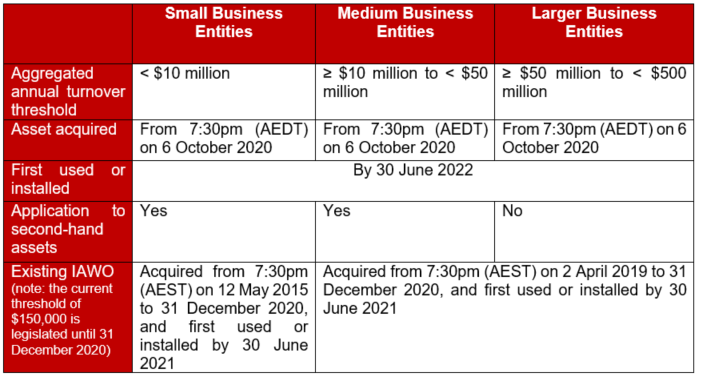

Businesses with an aggregated annual turnover of less than $5 billion will be able to claim an immediate deduction for the full (uncapped) cost of an eligible depreciable asset, in the year the asset is first used or is installed ready for use, where the following requirements are satisfied:

• The asset was acquired from 7:30pm AEDT on 6 October 2020 (i.e., Budget night).

• The asset was first used or installed ready for use by 30 June 2022.

• The asset is a new depreciable asset or is the cost of an improvement to an existing eligible asset, unless the taxpayer qualifies as a small or medium sized business (i.e., for these purposes, a business with an aggregated annual turnover of less than $50 million), in which case the asset can be second-hand.

Small businesses with aggregated annual turnover of less than $10 million will be able to deduct the balance of their depreciation pool at the end of the income year up to 30 June 2022.

Businesses with aggregated annual turnover between $50 million and $500 million can still deduct the cost of eligible second-hand assets costing less than $150,000 that are purchased from 2 April 2019 and first used or installed ready for use between 12 March 2020 and 31 December 2020 under the enhanced instant asset write-off. The Government will extend the period in which such assets must first be used or installed ready for use by 6 months, until 30 June 2021.

Temporary loss carry back for eligible companies

The Government will re-introduce a "loss carry-back" mechanism to allow companies with a turnover of less than $5 billion that have paid tax in the past but are now in a tax loss position, to carry back losses from the 2020, 2021 or 2022 income years to offset previously taxed profits made in or after the 2019 income year.

This will allow such companies to obtain a refund of some of the tax they previously paid by generating a refundable tax offset in the year in which the loss is made. The tax refund is limited by requiring that the amount carried back is not more than the earlier taxed profits and that the carry back does not generate a franking account deficit.

The tax refund will be available on election by eligible companies when they lodge their tax returns for the 2021 and 2022 income years. Companies that do not elect to carry back losses under this measure can still carry losses forward as normal.

Research & Development Tax Incentive

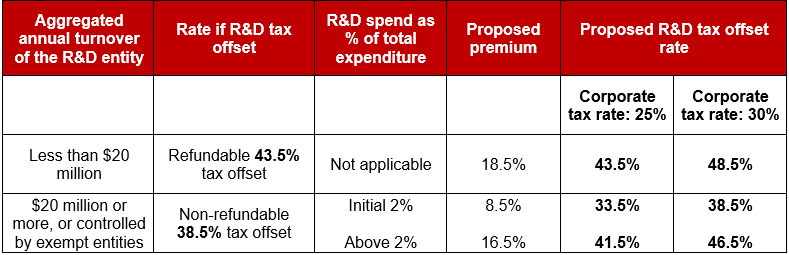

The Government has announced that it will make additional enhancements to the proposed changes to the R&D tax incentive, which are currently before the Senate.

Small R&D entities (with an aggregated annual turnover of less than $20 million) will be able to access the refundable R&D tax offset at a premium of 18.5% above their corporate tax rate. The Government has stated that it will not proceed with the $4 million cap on annual cash refunds for small R&D entities.

The intensity tiers for larger R&D entities (with an aggregated annual turnover of $20 million or more) will be reduced from three tiers to two as detailed in the table below.

The Government has decided to defer the start date of this measure so that all changes to the R&D tax incentive program apply to the income years starting on or after 1 July 2021. The Government’s decision to defer the proposed changes to reform the R&D tax incentive means that the existing rules will continue to apply until the end of the 2021 income year.

Wage subsidy for new apprentices

The Government will provide a capped 50% wage subsidy to businesses who take on a new Australian apprentice from 5 October 2020 to 30 September 2021.

It will be available to employers of any size or industry, Australia-wide – regardless of geographic location or occupation. There are 2 important caps:

- it is limited to 100,000 new apprentices or trainees in total; and

- the 50% subsidy will be limited to $7,000 per quarter (i.e. $28,000 per annum).

More information can be found on the Department of Education, Skills and Employment website. It states that the payment will be paid in respect of commencing or recommencing apprentices – i.e., it will be possible to re-employ former apprentices whose employment had been terminated.

The Department of Education, Skills and Employment states that the start date for claims is 1 January 2021, i.e. that payments will be made in arrears. It also provides details as to how to register.

Other announcements

Capital Gains Tax (CGT) exemption for "granny flat" arrangements

Under this measure, CGT will not apply to the creation, variation or termination of a granny flat arrangement providing accommodation where there is a formal written agreement in place. The Budget states that it will apply to arrangements that provide accommodation for "older Australians or those with a disability". There are no further details as to what constitutes "older" or "disability".

The exemption will only apply to agreements that are entered into because of "family relationships or other personal ties" and will not apply to commercial rental arrangements.

FBT exemption for retraining redeployed employees

The Government announced that it will provide an FBT exemption for employer-provided retraining and reskilling benefits provided to redundant, or soon to be redundant, employees where the benefits are not related to their current employment.

Currently, FBT is payable if an employer provides training to its employees that is not sufficiently connected to their current employment. For example, a business that retrains their sales assistant in web design to redeploy them to an online marketing role in the business can be liable for FBT. By removing FBT, the Treasurer said employers will be encouraged to retain redundant employees to prepare them for their next career.

The FBT exemption will not extend to retraining acquired by way of a salary packaging arrangement or training provided through Commonwealth supported places at universities, which already receive a benefit, or extend to repayments towards Commonwealth student loans.

The FBT exemption will apply from 2 October 2020.

FBT record-keeping - reducing compliance burden

To reduce the FBT compliance burden, the Government will provide the ATO with the power to allow employers to rely on existing corporate records, rather than employee declarations and other prescribed records, to finalise their FBT returns.

Currently, the FBT legislation prescribes the form that certain records must take and forces employers, and in some cases employees, to create additional records in order to comply with FBT obligations.

This measure will apply from the start of the first FBT year (1 April) after the date the enabling legislation receives assent.

Superannuation guarantee - no change to rate increase set for July 2021

The Budget did not announce any change to the timing of the next Super Guarantee (SG) rate increase. The SG rate is currently legislated to increase from 9.5% to 10% from 1 July 2021, and by 0.5% per year from 1 July 2022 until it reaches 12% from 1 July 2025.

Paid Parental Leave - alternative work test

The Government announced in the Budget that it is also supporting new parents whose employment was interrupted by the COVID-19 pandemic by introducing an alternative Paid Parental Leave work test period for a limited time.

Under normal circumstances, parents must have worked 10 of the 13 months prior to the birth or adoption of their child to qualify, but that is being temporarily extended to 10 months out of the 20 months for births and adoptions that occur between 22 March 2020 and 31 March 2021. This measure is estimated to allow about 9,000 mothers to regain eligibility for Parental Leave Pay and allow a further 3,500 people to claim Dad and Partner Pay.

IMPORTANT: all the above measures are merely announcements are not yet law. We strongly recommend that you wait for the measures to be legislated to ensure that all eligibility criteria and mechanics of the concessions are known prior to making major business decisions.

As always, the Ruddicks partners and staff are here to help with any questions you may have about the above announcements or any taxation matters.

DISCLAIMER:

Liability limited by a scheme approved under Professional Standards Legislation.

The content of this newsletter is general in nature. It does not constitute specific advice and readers are encouraged to consult their Ruddicks adviser on any matters of interest. Ruddicks accepts no liability for errors or omissions, or for any loss or damage suffered as a result of any person acting without such advice. This information is current as at 7 October 2020, and was published around that time. Ruddicks particularly accepts no obligation or responsibility for updating this publication for events, including changes to the law, the Australian Taxation Office’s interpretation of the law, or Government announcements arising after that time.

Any advice provided is not ‘financial product advice’ as defined by the Corporations Act. Ruddicks is not licensed to provide financial product advice and taxation is only one of the matters that you need to consider when making a decision on a financial product. You should consider seeking advice from an Australian Financial Services licensee before making any decisions in relation to a financial product. © Ruddicks 2020