Foreign tax residents with HECS/HELP & TSL debt now have to make compulsory repayments and report their worldwide income to the ATO

In a widely publicised move, the Australian Government has introduced changes relating to Higher Education Loan Program (HELP – previously HECS) and Trade Support Loan (TSL) repayment obligations.

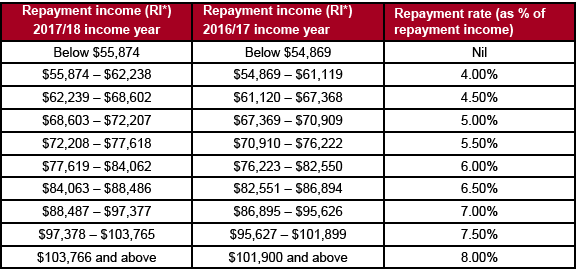

The first loan repayments will commence from 1 July 2017 and will be based on your worldwide income for the 2016/17 Australian income year (that is, from 1 July 2016 to 30 June 2017). Similarly to if you were living and working in Australia, if you live and work overseas and earn worldwide income that exceeds the minimum HELP and TSL repayment thresholds, you will be required to make repayments against your loan. Previously, individuals who studied in Australia and then moved overseas and earned foreign income could escape repayment of their HECS/HELP and TSL debts, possibly for life.

What are the repayment thresholds and rates?

*RI= Taxable income plus any total net investment loss (which includes net rental losses), total reportable fringe benefits amounts, reportable super contributions and exempt foreign employment income.

What does it mean for foreign residents with HECS/HELP/TSL debt?

Foreign residents with a HECS/HELP/TSL debt will need to report their worldwide income to the ATO via MyGov or through us. The reporting deadline for the 2016/17 Australian income year is 31 October 2017. It's important you report on time, even if you can't pay straight away as you'll avoid a penalty for lodging late.

After you have reported your worldwide income, you will receive a notice confirming:

- how much you owe or refund

- the due date for payment.

Your HECS/HELP and TSL debt will continue to be indexed each year until it is paid. You can make additional voluntary repayments from overseas at any time to reduce the balance of your debt but voluntary repayments will not reduce any compulsory repayment obligations you may have.

Further information about calculating your worldwide income is available on the ATO website.

Exemption from reporting

If you did not earn more than $13,717 AUD for the 2016/17 income year (from all sources, including foreign income) you will need to submit a non-lodgement advice. This is a document lodged in lieu of a tax return and which advises the ATO that you will not be lodging a return as you:

- are under the 25% minimum HELP and TSL repayment threshold, and

- have made a determination you have no requirement to report your worldwide income which includes lodging an individual income tax return.

The non-lodgement advice can be completed through ATO Online Services or through us.

If you are moving overseas and have HECS/HELP/TSL debt

You will need to notify the ATO, within 7 days of leaving Australia, if you intend to move or already reside overseas for 183 days or more in any 12-month period.

This involves completing an overseas travel notification and updating your contact details, including your mobile, international residential, postal and email addresses. This can be done online via ATO Online Services. More details can be accessed on the ATO website.

DISCLAIMER:

The contents of this publication are general in nature and we accept no responsibility for persons acting on information contained herein. The content of this newsletter does not constitute specific advice and readers are encouraged to consult their Ruddicks adviser on any matters of interest. © Ruddicks 2017