From 1 November 2021, New employees will keep their default super fund

Royal assent was received on the Your Future, Your Super measures on 22 June 2021 and these measures are now law.

The key measures are:

- Single Default Account (‘stapling’)

- Addressing underperformance in superannuation

- Improving accountability and member outcomes

So what’s this Single Default Account all about?

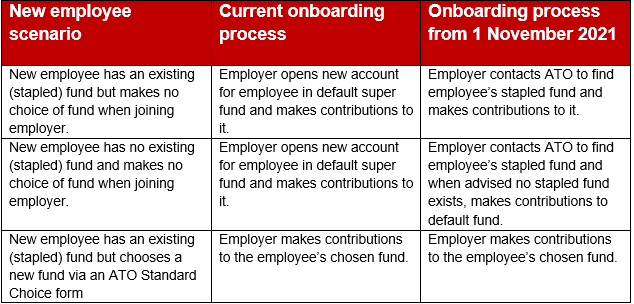

Single Default Account (‘stapling’) means employers will no longer automatically create a new super account in their default fund for employees who do not choose a super fund and start employment on or after 1 November 2021.

Instead, employers will be required to search for an employee’s existing (‘stapled’) fund by contacting the ATO (portal to be confirmed) and direct contributions to that fund. It’s important to note that if a member does advise the employer of their choice of super fund, the employer is then not required to contact the ATO to confirm the new employee’s stapled fund.

How it works

Frequently Asked Questions

What happens if there is no stapled fund?

Where there is no stapled fund and no other fund nominated, super contributions can be made into the default fund.

How do you find details of a new employee’s stapled fund?

You will be able to find the details of a new employee’s stapled fund by contacting the ATO. The ATO is currently designing a solution for the employer superannuation account stapling service.

What happens if the employee has multiple existing funds?

Where a member has multiple existing funds, the ATO will apply tiebreaker rules to identify the stapled fund. The rules consider the most recent fund identified by the ATO, the fund that received the most recent contribution, the fund that held the largest account balance and other factors such as when the employee became a member, or holder, of each eligible fund.

What happens if I have an enterprise bargaining agreement (EBA)?

If you have an EBA in place and a new employee has not chosen a superannuation fund but has an existing stapled fund, you must make contributions to that stapled fund.

If the new employee does not have a stapled fund, you are able to open a super account for them in your default fund specified under a workplace determination or an EBA, provided the determination or agreement was made before 1 January 2021.

What about existing employees?

Existing employees aren’t affected by these changes. You must continue to make their compulsory superannuation guarantee (SG) payments into the same super fund account you do today.

If a new employee completes the ATO Standard choice form, do employers still need to contact the ATO to see if this is their stapled fund?

No. If an employee elects their choice of super fund using the ATO Standard Choice Form, you must make payments to this account. You do not need to contact the ATO to confirm their stapled fund details in this instance. Be sure to keep a copy of the Standard Choice form on file to demonstrate compliance.

What does this mean for your onboarding process?

The new stapling rules mean you will have to review the onboarding material you supply to new employees including their Letter of offer to ensure that these correctly reflect this change to choosing a superannuation fund.

How do I contact the ATO?

The ATO has confirmed the employer request stapled super fund service will be a two phased approach:

Phase 1 – 1 November 2021

- Employers will need to use the request stapled super fund service for employees who commence on or after 1 November 2021 and haven’t chosen a super fund.

- A temporary solution for bulk requests of employee stapled fund details will be available for employers to use.

Phase 2 – 1 July 2022

- A wholesale service will automate the interaction between employer’s payroll systems and the ATO when requesting stapled super fund details.

- Uptake on phase 2 is voluntary.

- Solution may be available earlier depending on design timelines with Digital Service Providers.

Your Future, Your Super reforms

In the 2020–21 federal Budget, the government announced the Super Reforms – Your Future, Your Super measure.

The measure has four key elements:

- A new YourSuper comparison tool for individuals to be able to compare key data on MySuper products can be found here.

- A change to the duties of trustees of superannuation funds to act in the best financial interest of their members.

- A new super fund underperformance assessment to be conducted by APRA and published on the ATO website.

- From 1 November 2021, where new employees do not choose a super fund, most employers will have to check with the ATO if their employee has an existing stapled super account, to pay the employee's super guarantee into (as detailed above).

Want to learn more?

DISCLAIMER:

Liability limited by a scheme approved under Professional Standards Legislation.

The content of this newsletter is general in nature. It does not constitute specific advice and readers are encouraged to consult their Ruddicks adviser on any matters of interest. Ruddicks accepts no liability for errors or omissions, or for any loss or damage suffered as a result of any person acting without such advice. This information is current as at 29 September 2021, and was published around that time. Ruddicks particularly accepts no obligation or responsibility for updating this publication for events, including changes to the law, the Australian Taxation Office’s interpretation of the law, or Government announcements arising after that time.

Any advice provided is not ‘financial product advice’ as defined by the Corporations Act. Ruddicks is not licensed to provide financial product advice and taxation is only one of the matters that you need to consider when making a decision on a financial product. You should consider seeking advice from an Australian Financial Services licensee before making any decisions in relation to a financial product. © Ruddicks 2021