The proposed Mineral Resource Rent Tax repeal will reduce tax concessions for small businesses

The revenue expected from the MRRT was intended to fund a number of tax concessions, including advantageous changes to the depreciation rules for small business entities ('SBEs', generally defined as an entity carrying on a business with an annual turnover of less than $2 million), the company loss carry-back regime and the superannuation contribution to low income earners. As a result of the Government’s proposal to repeal the MRRT, these related measures will be discontinued.

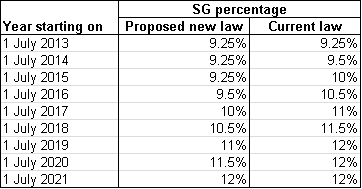

The gradual increase in the superannuation guarantee ('SG') rate to 12% is also linked to the MRRT and the effect of the Government’s proposal means that the increase to the SG will be delayed, deferring the time that the 12% rate will be reached.

Most significantly from 1 January 2014 small businesses will lose the $6,500 immediate asset deduction, which will be reduced to $1,000, and the $5,000 upfront motor vehicle deduction.

Instant asset write off rules for SBEs to change from 1 January 2014

Under the current law, small businesses with an annual turnover of less than $2 million are able to claim an immediate deduction for the value of a depreciating asset that costs less than $6,500 in the income year the asset is first used or installed ready for use. A small business entity can also deduct the first $5,000 of the cost of a motor vehicle up-front, plus 15 per cent of the remaining cost, in the income year that it is first used or is ready for use.

As a result of the proposed changes, the $6,500 immediate deduction for depreciating assets and the up-front $5,000 deduction for motor vehicles will continue to apply only where the asset is first used or installed ready for use before 1 January 2014.

We advise small business entities to make any necessary capital purchases and have the assets installed on business premises before 31 December 2013 if they wish to take advantage of the $6,500 immediate deduction for depreciating assets and $5,000 deduction for motor vehicles.

Hint: For small businesses that are registered for GST, the $6,500 and $1,000 thresholds for the immediate deduction are GST-exclusive. This means that when looking at prices of assets, a total of $7,150 or $1,100 can be spent by a business that is registered for GST. A small business that is not registered for GST will only be able to spend $6,500 and $1,000 to access the immediate deduction.

If the proposed legislation is passed, the following changes will take effect from 1 January 2014:

- SBEs will be able to claim an immediate deduction for the value of depreciating assets that cost less than $1,000 in the income year the assets are first used or are installed ready for use;

- Depreciating assets that cost $1,000 or more can be allocated to a general small business pool to be depreciated at a rate of 15% in the year an asset is acquired and at 30% in subsequent income years;

- Motor vehicles are subject to the same rules as other depreciating assets and there will be no additional up-front deduction for depreciation.

Repeal of loss carry-back for companies

Presently companies can either carry their tax losses forward to use as a deduction in a future income year or carry up to $1 million in tax losses back to an earlier year (in which income tax was paid by the company) to obtain a tax offset.

If the repeal of the MRRT is passed, the loss carry-back for companies will be repealed with effect from 1 July 2013.

This will mean that only the tax losses incurred by companies in the 2013 income year can be carried back to offset taxable income in the 2012 income year.

Superannuation measures

The current staggered phasing in of the increase to the compulsory SG rate to 12% is to be postponed so that the 12% rate will not be reached until the income year starting on 1 July 2021. The table below compares the current and proposed SG rate increase:

The low income superannuation co-contribution will also no longer apply in respect of concessional contributions made on or after 1 July 2013 by eligible individuals.

Conclusion

Clearly, there is much debate and conjecture about whether the above measures will pass the current Senate. With Parliament rising for the year this week, the bill may not pass until next year or, indeed, not at all. It’s also possible that the effective dates of the measures could change – for example, the date of the abolition of the instant asset write-off could change from 1 January 2014 to 30 June 2014 or some other date. We’ll keep you posted with an update once a final outcome is known.

DISCLAIMER: The contents of this publication are general in nature and we accept no responsibility for persons acting on information contained herein. The content of this newsletter does not constitute specific advice and readers are encouraged to consult their Ruddicks adviser on any matters of interest. © Ruddicks 2013