What the May 2023 Federal Budget Means for Business Owners

The 2023 Federal Budget was announced on Tuesday 9 May 2023, with a focus on cost-of-living relief and modernising our economy.

There were only a few key tax and superannuation changes announced, which is good news. However, no mention was made of the previously announced Stage 3 Income Tax cuts that are planned to begin on 1 July 2024, and this has made many people wonder if the Government may cancel them next year.

There were 2 very important things not mentioned in the 2023 Budget that may affect you as a business owner:

- With Temporary Full Expensing finishing on 30 June 2023 and its replacement with a Small Business Instant Asset Write-off capped at $20,000, a business that sells or trades in a motor vehicle would have 100% of its sale price included in taxable income in the year it is sold if it fully expensed its purchase in an earlier year. For example, if a business trades in a vehicle (that was fully expensed) for $50,000 and purchases another vehicle for $60,000 in 2024, $50,000 will be included in its taxable income but only a portion of the $60,000 purchase price of the new vehicle will be allowed as a depreciation tax deduction. This may result in significantly higher tax payable by the business compared with previous years.

- The Low and Middle Income Tax Offset was not extended by the Government. This means individuals who received up to $1,500 in extra tax refunds last year will not receive them again in 2023.

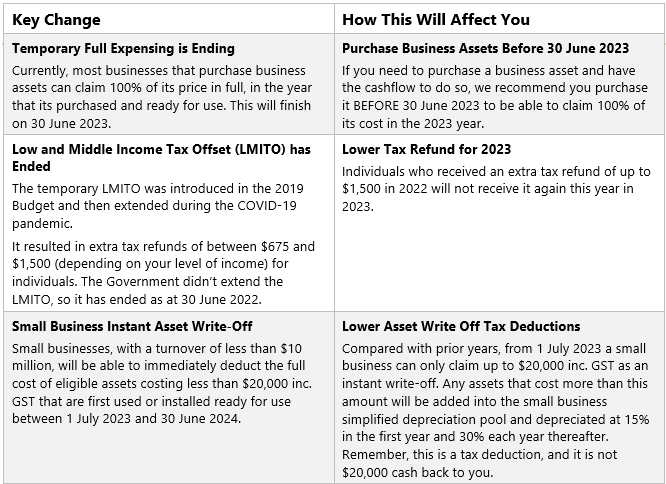

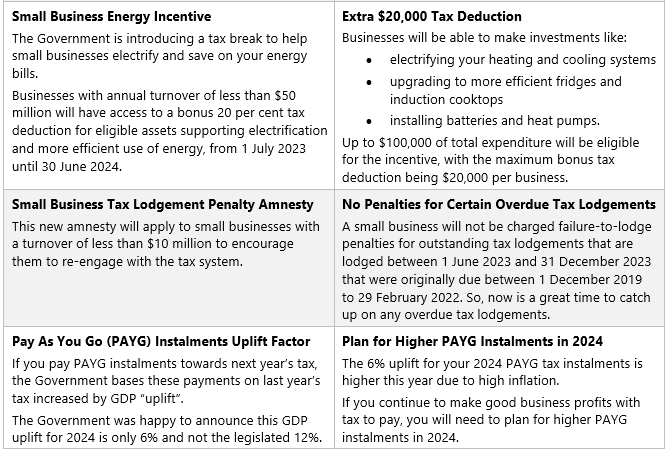

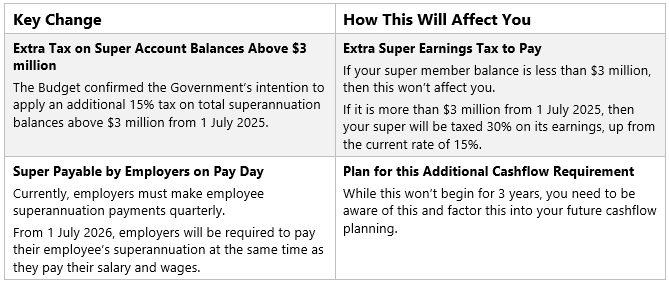

Here is a brief summary of the Budget updates relevant to the majority of our clients:

Taxation Changes

Superannuation Changes

Next Steps

To get the maximum benefits from the new measures announced in the 2023 Federal Budget, please contact us immediately to book in your 2023 Tax Planning meeting with us.

We look forward to assisting you!

DISCLAIMER:

Liability limited by a scheme approved under Professional Standards Legislation.

The content of this newsletter is general in nature. It does not constitute specific advice and readers are encouraged to consult their Ruddicks adviser on any matters of interest. Ruddicks accepts no liability for errors or omissions, or for any loss or damage suffered as a result of any person acting without such advice. This information is current as at 17 May 2023, and was published around that time. Ruddicks particularly accepts no obligation or responsibility for updating this publication for events, including changes to the law, the Australian Taxation Office’s interpretation of the law, or Government announcements arising after that time.

Any advice provided is not ‘financial product advice’ as defined by the Corporations Act. Ruddicks is not licensed to provide financial product advice and taxation is only one of the matters that you need to consider when making a decision on a financial product. You should consider seeking advice from an Australian Financial Services licensee before making any decisions in relation to a financial product. © Ruddicks 2023